CONTENTS

Overview of this week

Supermacro context

Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

Overview of this week

Crypto-related News:

International Monetary Fund (IMF) warns against granting crypto official currency or legal tender status.

Twitter rebrands to X.com, with Elon Musk aiming to make it a significant part of the global financial system. Musk hints at integrating payments and conducting the entire financial world on X.com.

Japan Prime Minister supports #crypto, believes it can transform the internet.

Presidential candidate Robert F. Kennedy Jr. buys 14 #Bitcoin ($415,000).

US House Financial Services Committee passes a bill for #crypto regulatory framework.

Sam Bankman-Fried donates $93 million in stolen customer funds to US politicians but sees a dropped criminal charge.

SEC Chair Gary Gensler warns that crypto is speculative and fraud-prone.

House Financial Services Committee passes a bill protecting the right to self-custody #Bitcoin & crypto.

Financial News:

Federal Reserve raises interest rates by 25bps, reaching a 22-year high.

European Central Bank (ECB) raises all rates by 25bps as expected, continuing its rate hike cycle.

US GDP grows 2.4% on an annualized basis between April and June, according to preliminary figures from the Department of Commerce.

US inflation, as measured by PCE Price Index, falls to 3% YoY in June, below market expectations.

Core PCE Price Index stands at 4.1% YoY, down from 4.6% in May and below market forecasts.

Bitcoin (BTC)

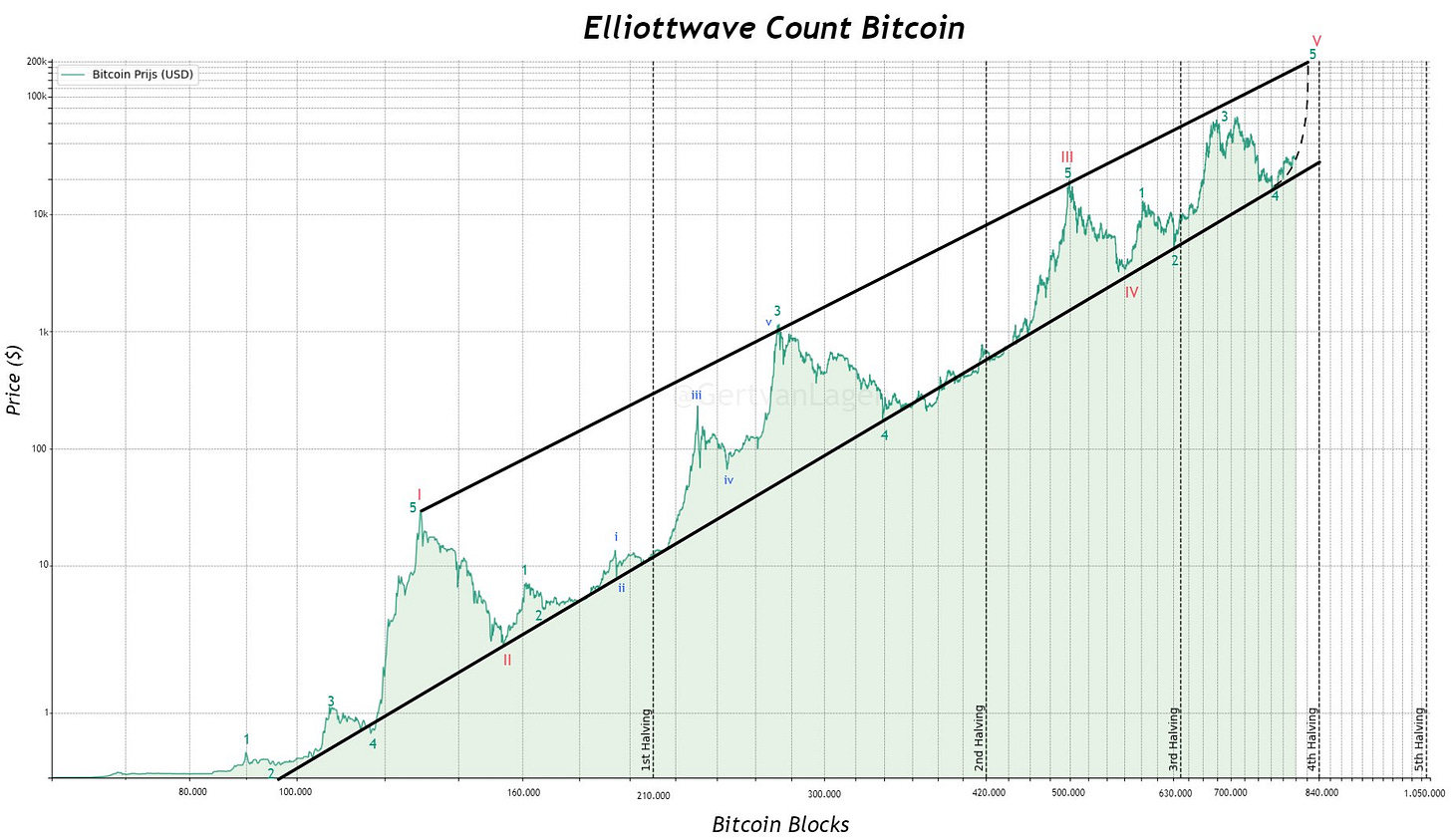

Update on the supermacro Elliott Wave count:

I. The first impulse wave, which consists of subwaves 1 to 5.

II. The first correction (ABC) following the initial impulse.

III. The second impulse wave, encompassing subwaves 1 to 5. Notably, subwave 3 further contains sub-subwaves i to v.

IV. The second correction (ABC) following the second impulse.

V. The third and final impulse wave, which comprises subwaves 1 to 4, subwave 5 is currently in the making.

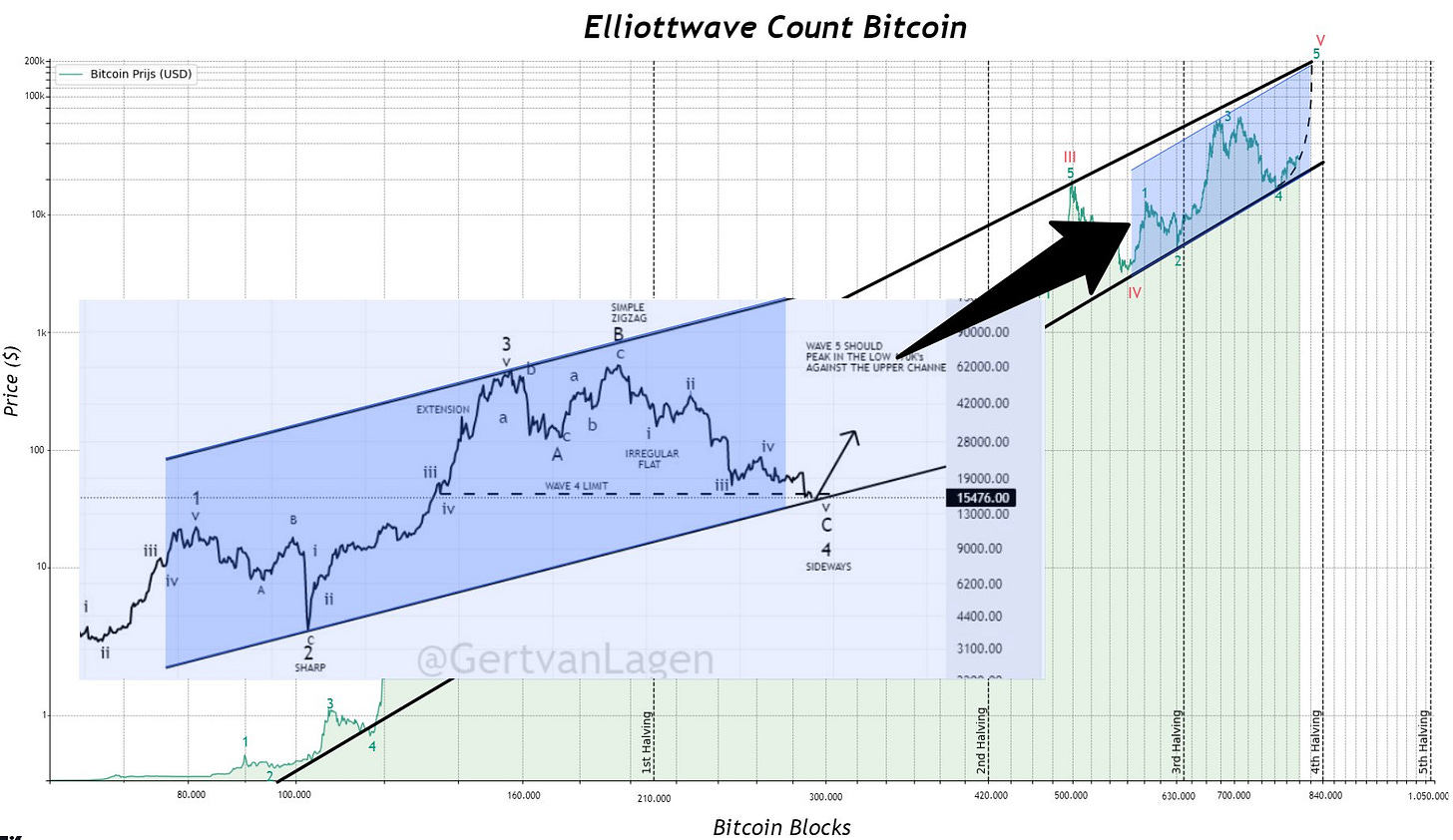

At present, Bitcoin finds itself in subwave 5 of the fifth and final impulse wave (V).

Some crucial factors that indicate a potential blow-off scenario, targeting approximately $200k for subwave 5 of wave V, are:

It aligns very well with the upper trendline of the channel drawn through points 2, 3, 4 of wave V.

It aligns very well with the upper trendline of the 10-year+ rising wedge, represented by the black trendlines.

Historical data shows that Bitcoin tends to hit either the 2.272 (BLUE) or 2.414 (RED) extension of former bear markets. The 2.272 extension of IV-bear market perfectly aligns with the $200k target.

Why a blow-off scenario now?

Stock markets are experiencing a blow-off phase, and Bitcoin usually follows similar trends. Especially the direction-correlation with the Nikkei is screaming for a fresh ATH for BTC as well.

Yield spread data indicates a high likelihood of an impending recession.

Past experience during the COVID-induced dip showed that Bitcoin is not resilient to stock market dumps, leading us to expect a similar pattern during an economic downturn.

Invalidation points:

If the subcount wave V drops below $13.8k, the current outlook may not hold.

A break in the step-like formation before the halving could result in an extended W5 into 2025, with a potential target of $200k+ —> 2.414 extension too. Considering the likelihood of an impending recession, I think this scenario is less likely to play out.

The blow-off scenario to the upper black trendline may be invalidated if the lower trendline of the 10-year+ rising wedge is broken during a recession before the price reaches wave V.