CONTENTS

Overview of this week

Bitcoin - $BTC

2Y+ channel

Step-like formation

Altcap

Stocks (SP500, Nasdaq)

US Dollar Index (DXY)

Supermacro context

Bitcoin

SP500

US Dollar Index (DXY)

Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

NEW: Key take aways

Bitcoin tested $40k, parabolic move intact, next resistance $47.2k

Altcoins are moving up, still lagging a bit w.r.t. BTC

SP500 and Nasdaq had a big rally this week, both are close to a fresh ATH

The dollar has dumped strongly, the bearish pattern on the 4h chart played out as expected.

News of this week

The Federal Reserve has decided to maintain the current interest rates, keeping them in the range of 5.25% to 5.50%. Federal Reserve Chair Jerome Powell expressed satisfaction with progress on inflation, and BlackRock views his statement as a positive signal for investors.

The Consumer Price Index (CPI) experienced a decline to 3.1% in November, down from 3.2% in October and 3.7% in September.

The Securities and Exchange Commission (SEC) held a meeting with BlackRock to discuss the company's Spot Bitcoin ETF.

The Bitwise Spot Bitcoin ETF has been officially listed on the Depository Trust & Clearing Corporation (DTCC) under the ticker symbol $BITB.

A Bloomberg report reveals that the Financial Accounting Standards Board (FASB) has introduced new rules stating that cryptocurrency will be measured at fair value. These rules are expected to take effect in 2025 and could significantly impact crypto holdings.

The SEC has rejected Coinbase's petition seeking transparent rules and regulations for cryptocurrencies. In response, Coinbase has filed a lawsuit against the SEC challenging the denial of transparent crypto regulation.

President Donald Trump has launched a new collection of NFTs titled 'Mugshot.'

Elizabeth Warren, a US Senator, has proposed a bill aimed at increasing regulation on cryptocurrencies.

Tweet of this week —> “The FED is fighting yesterday’s battle.”

Bitcoin (BTC)

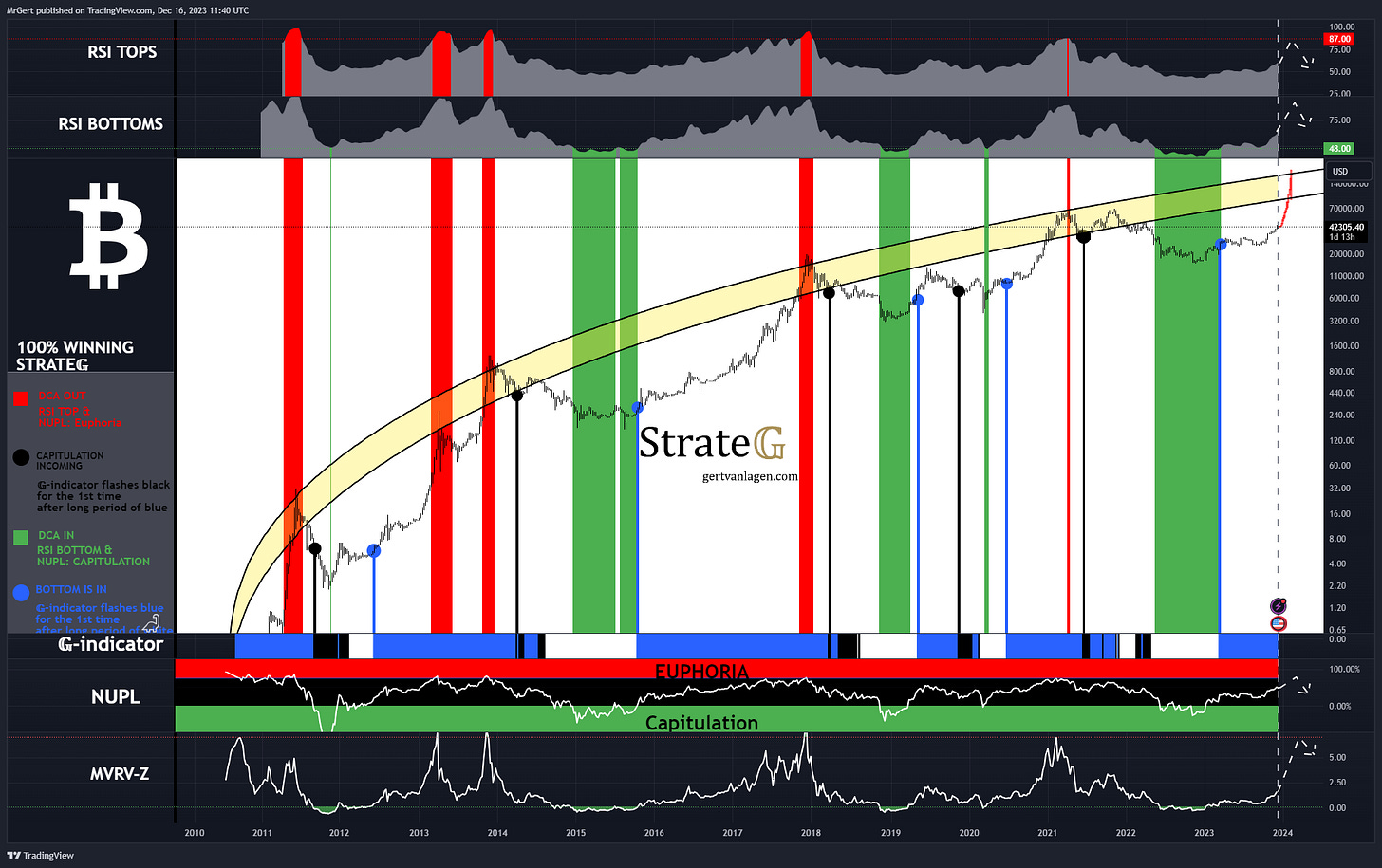

Let’s start this week with an update of the 100% winning STRATE𝔾 for #Bitcoin.

🟩 Market capitulates, <DCA IN>

RSI BOTTOMS flashes green

NUPL hits green ‘Capitulation’ zone

MVRZ hits green horizontal

🔵 Market starts bullrun, <BOTTOM IS IN>

Best to be fully scaled in at this point

𝔾-indicator flashes black after long time blue

🟥 Market is in Euphoria, <DCA OUT>

RSI TOPS flashes red

NUPL hits red ‘Euphoria’ zone

MVRZ hits red horizontal

(Option: start selling only in the yellow exponential curve zone)

⚫ Market loses momentum, TOP IS IN

It’s time to fully scale out of the market

𝔾-indicator flashes black after long time blue

Last four times first a dead-cat bounce occurred, after which the second wave down kicked in. Great opportunity to scale out.

Only prior to the COVID dip in March 2020 the black signal flashed without first the red signal. This was a strong signal to scale out of the market as soon as possible. Since the blue signal was at a lower level, this was possible directly without any loss. During the COVID dip the green signal flashed, showing a buying opportunity. Shortly thereafter a blue signal came in, showing it was best to be all-in again.