CONTENTS

Overview of this week

Bitcoin - $BTC

Shortterm Elliott Wave

2Y+ channel

Step-like formation

Ethereum - $ETH

Altcap

Stocks

US Dollar Index (DXY)

Supermacro context

Bitcoin

SP500

US Dollar Index (DXY)

Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

Overview of this week

Crypto News:

Grayscale has submitted an SEC application to transform its Ethereum trust into a spot ETF.

Sam Bankman-Fried, who reportedly offered $5 billion to dissuade Donald Trump from running in the 2024 presidential election, is now facing a trial for one of the most significant fraud cases in U.S. history and could potentially serve up to 115 years in prison.

Financial News:

U.S. mortgage rates have reached their highest level in over 22 years.

Iraq is planning to prohibit all cash withdrawals in U.S. dollars.

The US jobs report raises important questions. Despite the addition of 336,000 new jobs vs. 170,000 expected, the unemployment rate remained at 3.8 percent, with 6.4 million unemployed individuals. Moreover, the number of long-term unemployed barely changed at 1.2 million, and 5.5 million people wanting jobs weren't counted as unemployed. Government employment increased by 73,000, accounting for 22% of new jobs, while the transportation sector saw minimal growth. Furthermore, 151,000 of the new jobs are part-time, with 132,000 being secondary jobs!

Tweet of this week —> “Bears last dream”

Bitcoin (BTC)

Shortterm Elliott Wave - Update

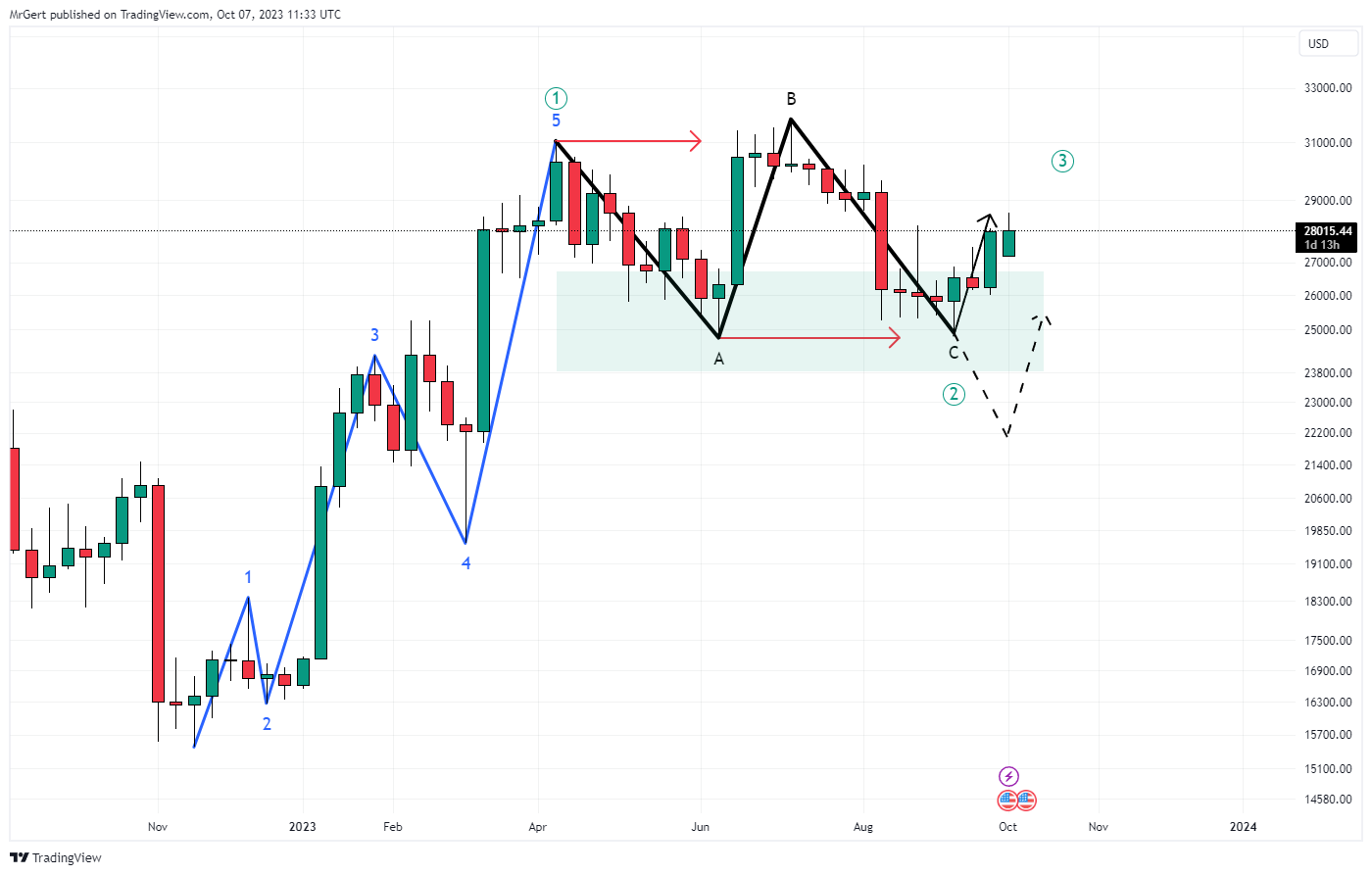

Three weeks ago I showed two options for the current correction in the short-term Elliott Wave we are tracking. So far price keeps opting for the running flat option, with this week another green candle distancing from the light-green rectangular box.

Running Flat: When C is higher than A, I expect it for 95% to play out this way, invalidation lies at $24.8k.

Irregular Flat: When C is lower than A, I expect it for 5% to play out this way, with a bottom target set at $22k at the 0.5 Fib level of W1.

Note that the Higher-High-Higher-Low pattern since November is maintained so far. To change the bullish narrative, the price needs to drop below $24.8k, which hasn't happened. The August monthly was in between the blue and red line in no-man's-land, a region where price still resides and hence a cautious stance remains important