The information and insights are based on my knowledge; don’t take it as financial advice.

News

Warren Buffett claims he could solve the U.S. deficit in five minutes:

"If the deficit exceeds 3% of GDP, Congress members lose re-election eligibility."Bitcoin's clean energy use surpasses 50%; Tesla previously hinted at resuming Bitcoin payments under such conditions.

U.S. Congress plans to focus on crypto laws starting in 2025.

Russia admits using Bitcoin for global transactions, aiming to bypass sanctions.

Russia imposes a six-year ban on crypto mining in 10 regions, citing energy issues.

IRS confirms staking rewards are taxable income.

Key Metrics

Current status 100% Winning strategy: 🔵—> ALL-IN

a weekly candle close below $67.5k would flash the black signal.

10Y-2Y Yield Spread is well above zero

market top before recession to be expected within 3 months

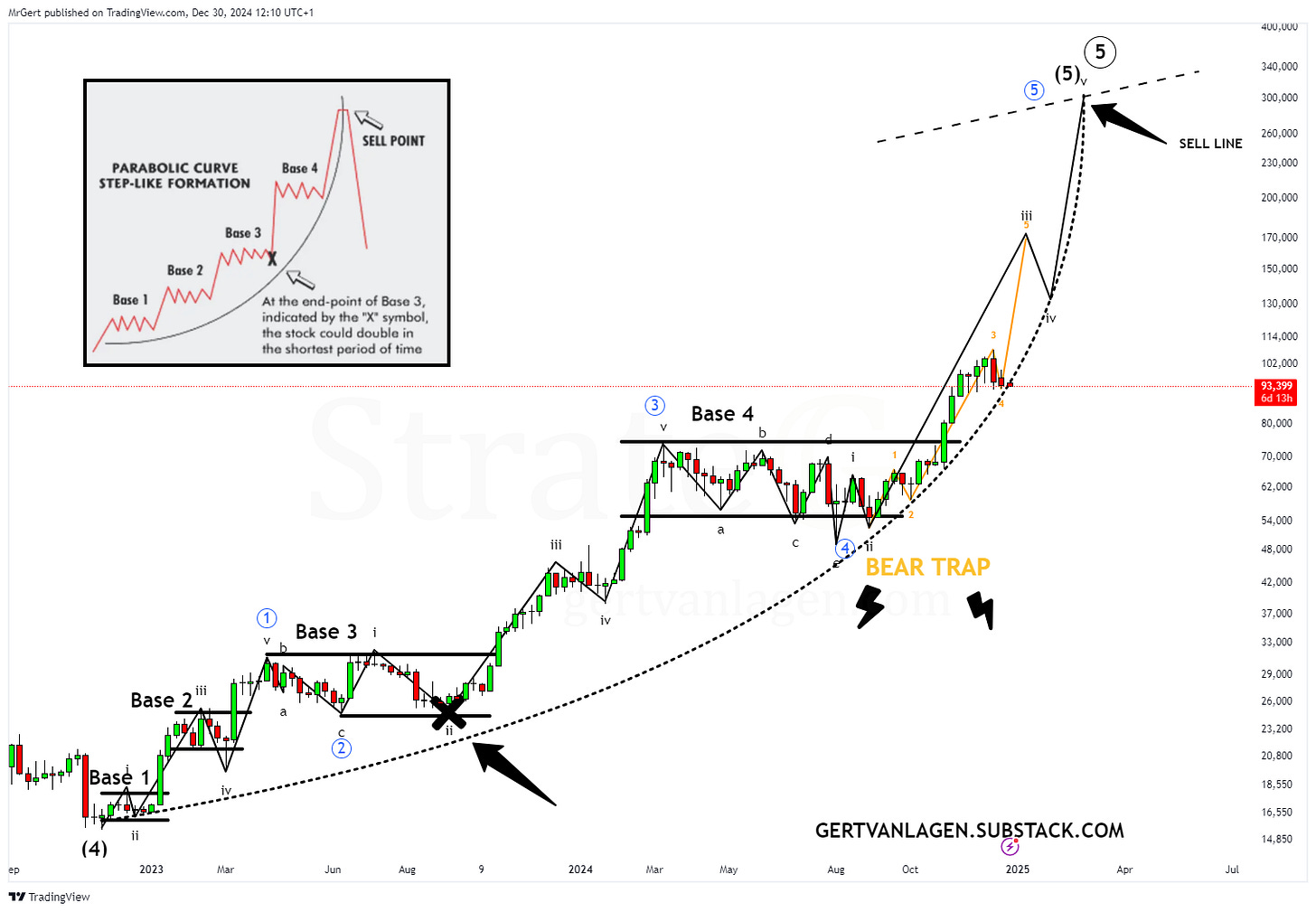

The market has consolidated this week following a significant dip last week. From an Elliott Wave perspective, this represents a clean orange subwave 4, within wave iii, within blue wave ⑤. A slightly lower price level at the end of the year is normal, as many investors trade based on that timeframe. It’s also beneficial for tax purposes in countries like The Netherlands, where the value of your portfolio is assessed as of January 1st. The price is setting up for the orange wave 5, completing wave iii. Once it prints an ATH, Bitcoin is primed to soar to $170k, followed by a dip to the lower Fibonacci level around $130k, and finally, a blow-off to the sell line at approximately $250k–$300k - at least that’s my expectation as off today.

Risk-On Warning: First Blow-Off incoming!

UPDATE: Major indicators are lining up in a pre-recession formation. The 10Y-2Y Yield spread has maintained its position above the 0 level after spending for 2 years below the zero line. Historically, a recession within 6-7 months after the reversal is to be expected. As the reversal happened in August 2024, the timeframe has now shrunk to within the next 2-3 months.

Sounds bad, but history shows also that the reversal ignited a final rally first. That’s what we are witnessing at the moment.

Accumulation / Re-Accumulation / Distribution

Bitcoin is blowing off as expected. Once the market tops after breaking out of the Re-Accumulation zone, a Distribution phase is to be expected, where late-party speculators are flipping coins with long-term holding sellers.