CONTENTS

Overview of this week

Bitcoin - $BTC

Shortterm Elliott Wave

2Y+ channel

Step-like formation

Ethereum - $ETH

Altcap

Stocks

US Dollar Index (DXY)

Supermacro context

Bitcoin

SP500

US Dollar Index (DXY)

Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

News of this week

Crypto:

Kasikornbank, Thailand's second-largest bank, makes a significant move by acquiring a local cryptocurrency exchange.

Swiss Bank St.Galler Kantonalbank enters the crypto custody arena, offering services for Bitcoin and Ethereum.

The United Kingdom is gearing up to implement crypto regulations by the year 2024.

PayPal receives the green light to provide cryptocurrency services in the United Kingdom, expanding its global reach.

It's been 15 years since Satoshi Nakamoto unveiled the groundbreaking Bitcoin whitepaper on October 31st. SEC Chair Gary Gensler acknowledges this milestone and its impact on the crypto world.

The SEC takes legal action against the SafeMoon cryptocurrency token and its executives, charging them with fraudulent activities. Notably, the founders, John Karony, Kyle Nagy, and Thomas Smith, have been arrested by the US government.

Sam Bankman-Fried faces a grim future as he is found guilty on all charges. He could potentially serve a maximum sentence of 115 years in prison, with the sentencing date set for March 28, 2024. US Attorney labels his actions as one of the most significant financial crimes in US history.

The Federal Reserve opts to put interest rate hikes on hold, maintaining the rates at 5.25% - 5.50%. This decision suggests that rates have peaked.

Other

In the final quarter of 2023, the US Treasury plans to borrow a substantial $776 billion.

The National Association of Realtors has been found guilty of conspiring to artificially inflate home sales commissions and is ordered to pay a hefty $1.8 billion in damages.

In October, the private sector disappoints by adding a mere 99,000 jobs, falling well short of expectations. The manufacturing sector, in particular, suffers significant job losses, surpassing projections.

Japan to approve $110bn stimulus package to fight inflation.

Tweet of this week —> “Nothing stops this train”

Bitcoin (BTC)

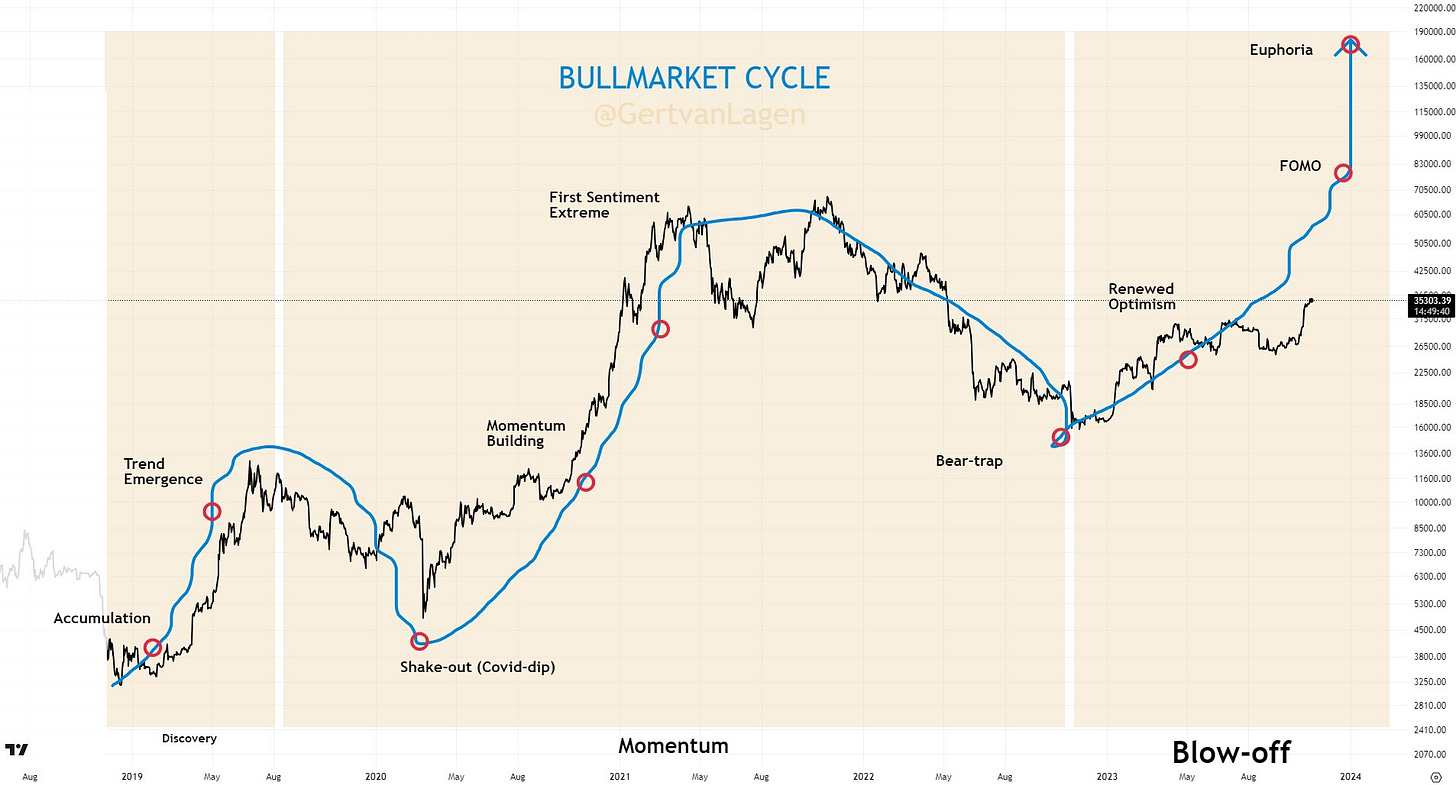

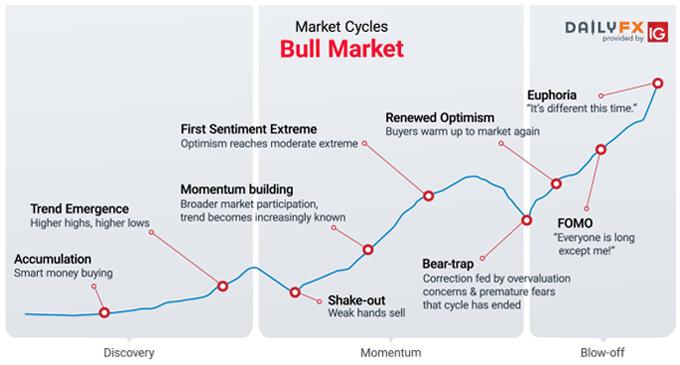

Let’s start with comparing the two figures below, take some time to read both carefully.

discovery….Momentum….BLOW-OFF

Shortterm Elliott Wave - Update

When zooming in on the last leg up, the third wave of the blow-off wave has started after this running flat correction.