CONTENTS

Overview of this week

Bitcoin - $BTC

2Y+ channel

Step-like formation

Altcap

Stocks (SP500, Nasdaq)

US Dollar Index (DXY)

Supermacro context

Bitcoin

SP500

US Dollar Index (DXY)

Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

News of this week

Crypto:

Binance has agreed to pay $4.3 billion to settle its case with the US Government. CEO Changpeng Zhao (CZ) has pleaded guilty to violating criminal anti-money laundering requirements, resulting in his resignation. The US alleges that Binance facilitated transactions for ISIS, Al Qaeda, and Hamas. CZ faces 18 months in prison as part of his plea deal and has been released from custody on a $175 million bond.

Tether has frozen $225 million in USDT linked to a human trafficking group.

The SEC has filed a lawsuit against the Kraken crypto exchange.

An SEC Commissioner has stated that "there's no reason for us to stand in the way of a Spot Bitcoin ETF."

Other

Javier Milei, a pro-Bitcoin candidate, has emerged victorious in the Argentina Presidential election. President Milei intends to replace the peso with the US Dollar and has confirmed plans to shut down the Central Bank.

Tweet of this week —> “Power-law corridor update”

Bitcoin (BTC)

Before each previous halving:

The upper green trendline was hit;

The lower green trendline was tested (together with halving SMA - blue/dashed);

EXCEPT this time, still waiting for hitting the upper green trendline at ~$200k before the halving.

2Y+ channel - Update

The parabolic surge of W5 has started. After the struggle of months (compare red circles), Bitcoin has succeeded to overcome the gravitation of the 2.25Y+ descending channel.

The main Fibonacci extension targets of W4 are at $150k, $170k and $220k, where the last one alignes closely with the upper trendline of the supermacro channel.

It's important to note that W5, being a blow-off wave, might exhibit a steep ascent as depicted, but the key point is that there's one final impulse left.

Here the updated chart:

Elliottwave count:

W1: 1st impulse

W2: 1st correction (zigzag, sharp)

W3: 2nd impulse (momentum)

W4: 2nd correction (expanded flat)

W5: 3rd impulse (blow-off, next up)

Flat correction?

Regarding the nature of the correction, yes, W4 retraced only 50% of W3 in a complex expanded flat pattern of ABC. In contrast, W2 was a sharp zigzag correction, retracing 90% of W1.

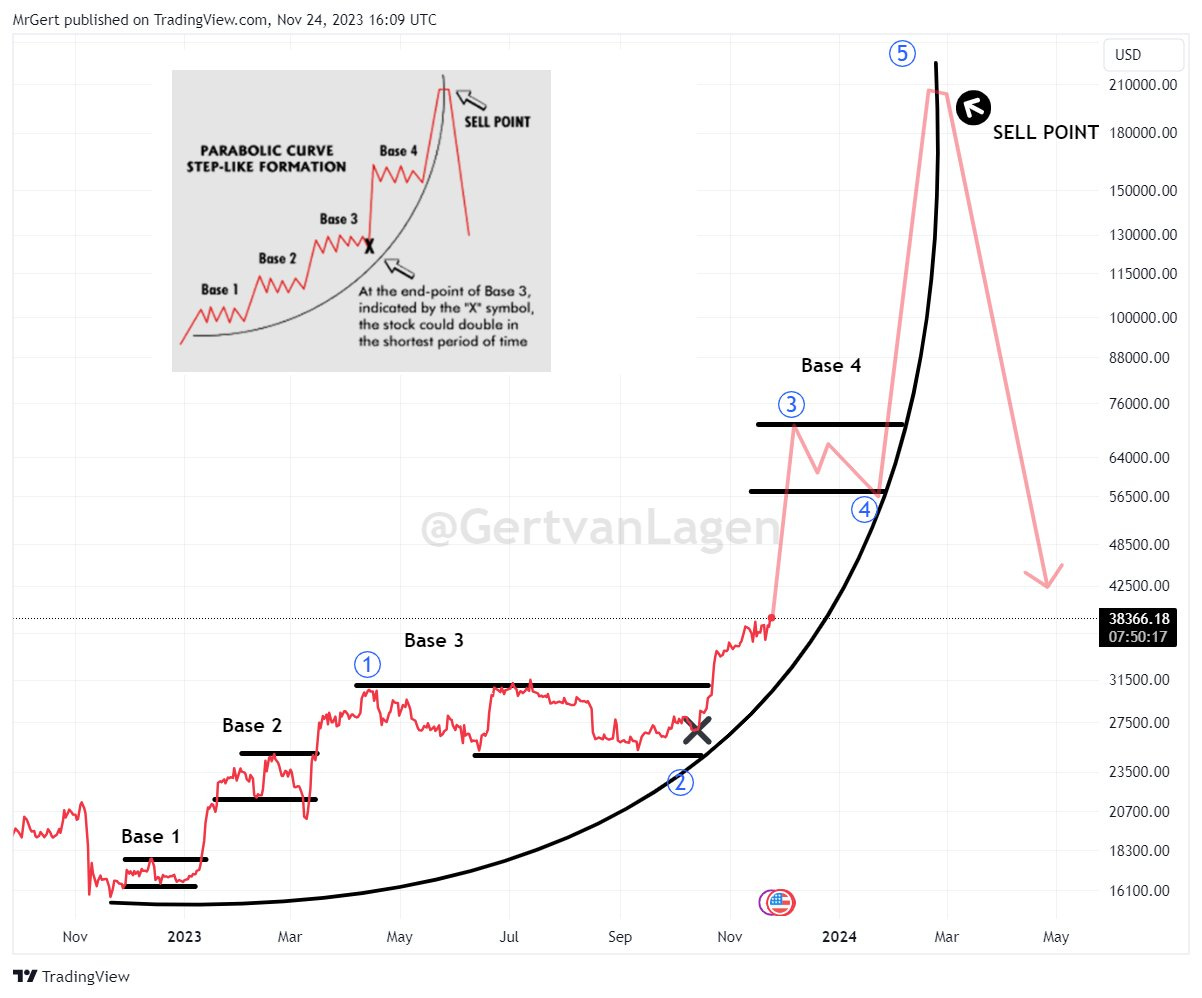

Step-like formation - Update

The long awaited impulsive bust to $60k+ in the shortest period of time has started.

In the mean time price is far above Base 3 already and on it's way to Base 4.

Here the updated chart:

Elliottwave count:

Wave 1: Base 1 to Base 3

Wave 2: Base 3 (Flat)

Wave 3: Base 3 to Base 4

Wave 4: Base 4 (Likely sharp)

Wave 5: Base 4 to SELL POINT