CONTENTS

Overview of this week

Bitcoin - $BTC

Shortterm Elliott Wave

2Y+ channel

Step-like formation

Ethereum - $ETH

Altcap

Stocks

US Dollar Index (DXY)

Supermacro context

Bitcoin

SP500

US Dollar Index (DXY)

Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

News of this week

Crypto:

Ferrari now accepts cryptocurrency as a form of payment for its vehicles.

The SEC opts not to contest a court ruling on Grayscale's Bitcoin ETF.

According to Bloomberg analysts, spot Bitcoin ETFs have a 90% likelihood of receiving approval.

OpenAI and ChatGPT CEO Sam Altman views Bitcoin as a significant technological advancement.

Fidelity, a $4.5 trillion asset management firm, states that Bitcoin is the most secure and decentralized digital currency in comparison to other digital assets.

Prosecutors allege a plot involving Sam Bankman-Fried and Caroline Ellison, his ex-girlfriend, to manipulate Bitcoin's price by selling customer BTC and influencing regulatory actions against Binance.

Other:

Israel reports the seizure of cryptocurrency wallets belonging to Hamas.

The U.S. national debt has been increasing at a rate of $1.2 billion per hour over the past 19 days.

U.S. inflation stands at 3.7%, exceeding earlier predictions.

Tweet of this week —> “BTC vs ETH”

Bitcoin (BTC)

Shortterm Elliott Wave - Update

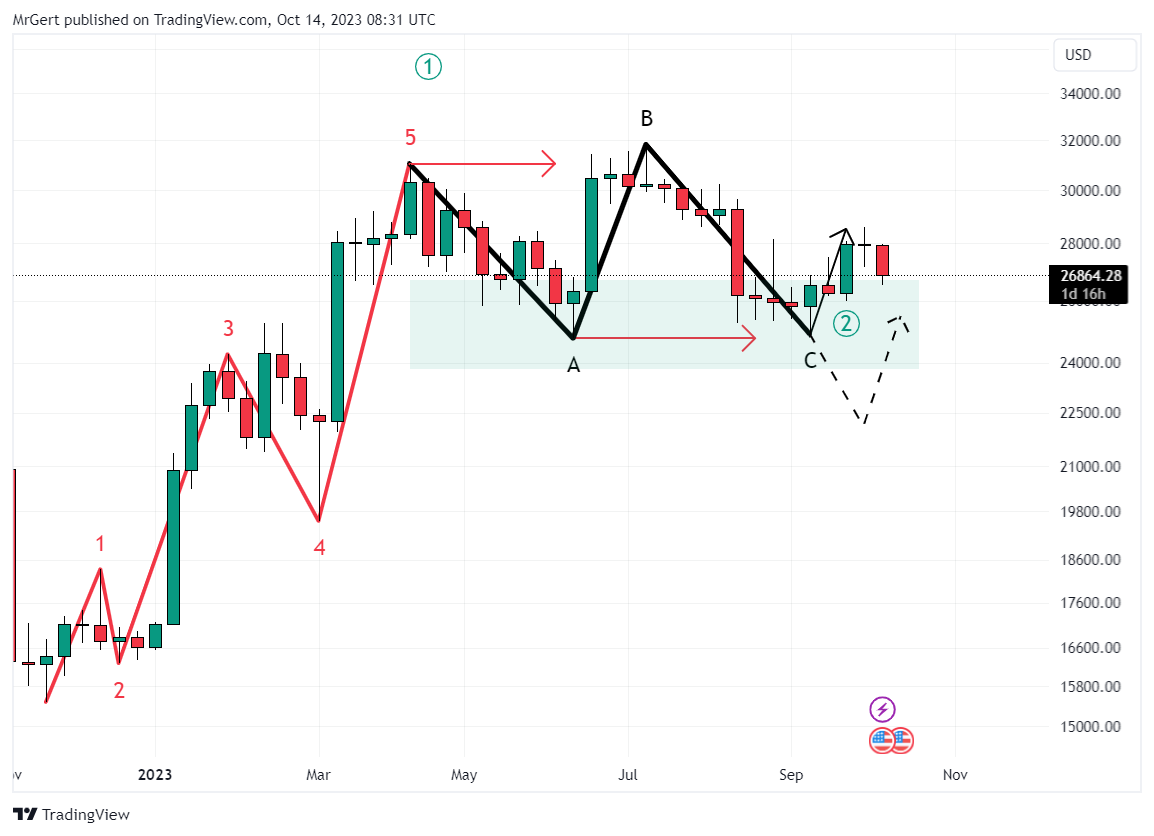

Four weeks ago I showed two options for the current correction in the short-term Elliott Wave started in Nov’22. So far price keeps opting for the running flat option, with this week a test of the light-green rectangular box.

Running Flat (solid black line): When C is higher than A, I expect it for 95% to play out this way, invalidation lies at $24.8k.

Irregular Flat (dashed black line): When C is lower than A, I expect it for 5% to play out this way, with a bottom target set at $22k at the 0.5 Fib level of W1.

FAQ

What does a Flat W2 imply?

From the alternation rule of EW-theory it suggests that W4 is likely to be a sharp zigzag correction, indicating a potentially volatile period after W3.

Why is the expectation only 5% for an irregular flat?

This low expectation suggests a drop to the 51-month Exponential Moving Average (EMA), an event that has occurred only approximately once every four years, with the last instance happening around a year ago. See also the next section about the DCA-zone.

Why is the expectation of a regular Flat 0%, when C retraces as deep as A?

Since B is a new high with respect to the red 5th wave top within W1, this option is invalidated.

2Y+ channel - Update

This week Bitcoin has been retesting the 2.25-year black descending channel after last week’s breakout. For now the struggle to distance from the trend continues.

If we breach 10% above the channel, approximately around 30,000, it's likely to initiate the parabolic surge of W5. It's important to note that W5, being a blow-off wave, might exhibit a steep ascent as depicted, but the key point is that there's one final impulse left.

Invalidation remains at 13.8k, where W4 should not be lower than W1.