Strate𝔾 Update - Week 12 | Q1 | 2024

"Embrace your tunnel vision when everything keeps playing out conform it."

Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

You can follow me also on Instagram: link

Strate𝔾 Channel update January: LINK TO YOUTUBE

Key take aways

BTC corrected slightly this week

S&P 500 and Nasdaq-100 both print fresh ATHs.

Is Gold recession proof?

I'd love to hear your thoughts or any suggestions you have for this newsletter! What rabbit hole should be explored in the next release?

News of this week

The Bitcoin halving is imminent, with fewer than 5,000 blocks remaining.

Japan's largest pension fund, valued at $1.43 trillion, is exploring the possibility of including Bitcoin in its investment portfolio.

The SEC is actively seeking to categorize Ethereum as a security through legal action.

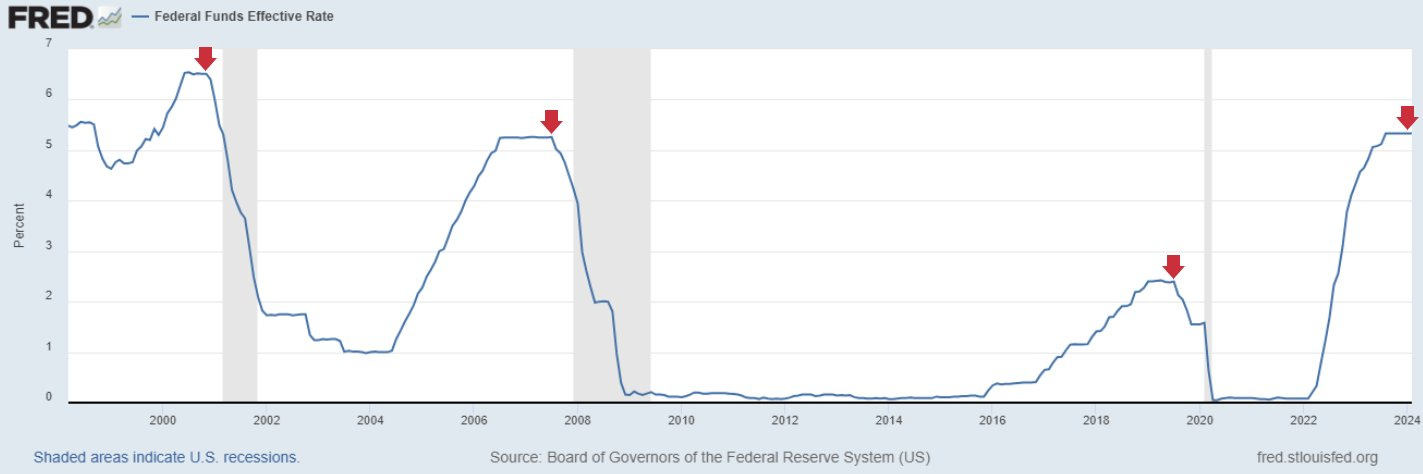

The Federal Reserve has opted to keep interest rates steady, maintaining them within the range of 5.25% to 5.50%. According to the dot plot, it suggests the likelihood of at least three rate cuts later in the year.

Tweet of this week —> “Alt season starts”

Current status 100% Winning strategy: 🔵—> ALL-IN

Federal Reserve Chairman Jerome Powell stated this week that interest rates have likely reached their peak and anticipates at least three rate cuts within the year. Following this announcement, the S&P 500 index swiftly reached another all-time high, while the U.S. Dollar Index (#DXY) faced resistance at lower time frame (LTF) levels.

The to be expected trajectory is clear: a potential blow-off top in the market followed by a significant economic downturn, as outlined in the analysis in the FED rate chart below: when the Federal Reserve initiates rate cuts, stocks typically decline and enter a recession within approximately a year, and with the expectation of three rate cuts this year, this scenario seems imminent.

The 10Y-5Y and 30Y-5Y yield spreads have reversed above 0, indicating that broad economic expectations are normalizing for the 5Y time window. For the 2Y and 3Y timeframes this is not the case yet, implying broad negative sentiment for the period until 2027.