Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

You can follow me also on Instagram: link

Strate𝔾 Channel update March: link

News of this week

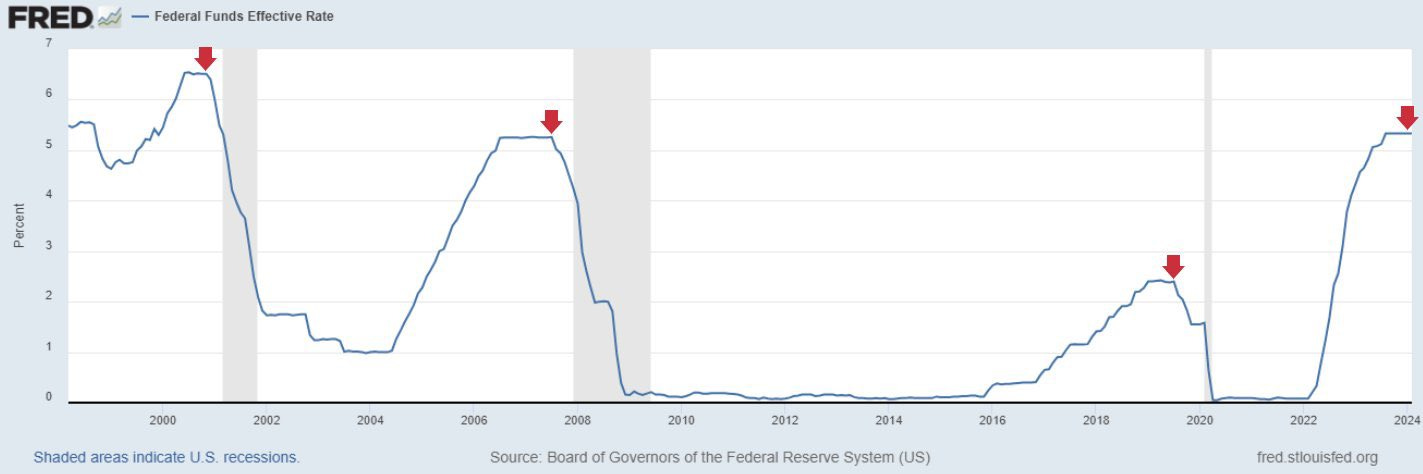

State Street, a $4 trillion asset manager, predicts the Federal Reserve will reduce interest rates by 50 basis points by June and by 150 basis points by the end of 2024.

Inflation in the US surges to 3.5%, surpassing forecasts. President Joe Biden suggests that today's inflation report could potentially postpone interest rate reductions.

Bloomberg reports that Hong Kong is on the verge of approving Bitcoin and Ethereum exchange-traded funds (ETFs) to be traded on the spot market by Monday.

The Bitcoin halving is imminent, with less than 1000 blocks remaining until the event occurs.

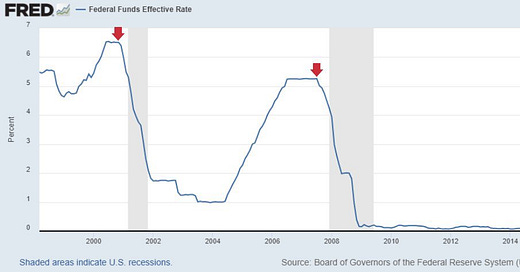

Tweet of this week —> “Am I the only one being happy with higher inflation for longer? This gives risk-on markets room to blow off and delays the onset of a severe recession that would likely follow strong rate cuts, as illustrated by the comparison with red arrows in the fed rate chart below (Grey areas are previous recessions)”

Current status 100% Winning strategy: 🔵—> ALL-IN