Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

News of this week

$130 billion asset manager Hightower purchases $68 million worth of spot Bitcoin ETFs.

$438 billion asset manager Susquehanna discloses a $1.3 billion Bitcoin ETF portfolio.

US House votes to overturn SEC rule preventing highly regulated financial firms from holding Bitcoin and crypto.

Wells Fargo, America's 3rd largest bank, discloses spot Bitcoin ETF holdings.

Largest US bank JPMorgan Chase discloses buying spot Bitcoin ETFs.

Former President Donald Trump pledges to stop hostility towards crypto in the US and embrace it. He criticizes President Biden's knowledge of crypto and suggests voting for him if you support crypto. Standard Chartered Bank predicts a positive impact on Bitcoin and crypto if Trump wins the presidential election. Trump plans to accept crypto donations for his campaign.

Mastercard, JPMorgan, Visa, Wells Fargo, and other top US banks are testing shared-ledger technology for tokenized asset settlements.

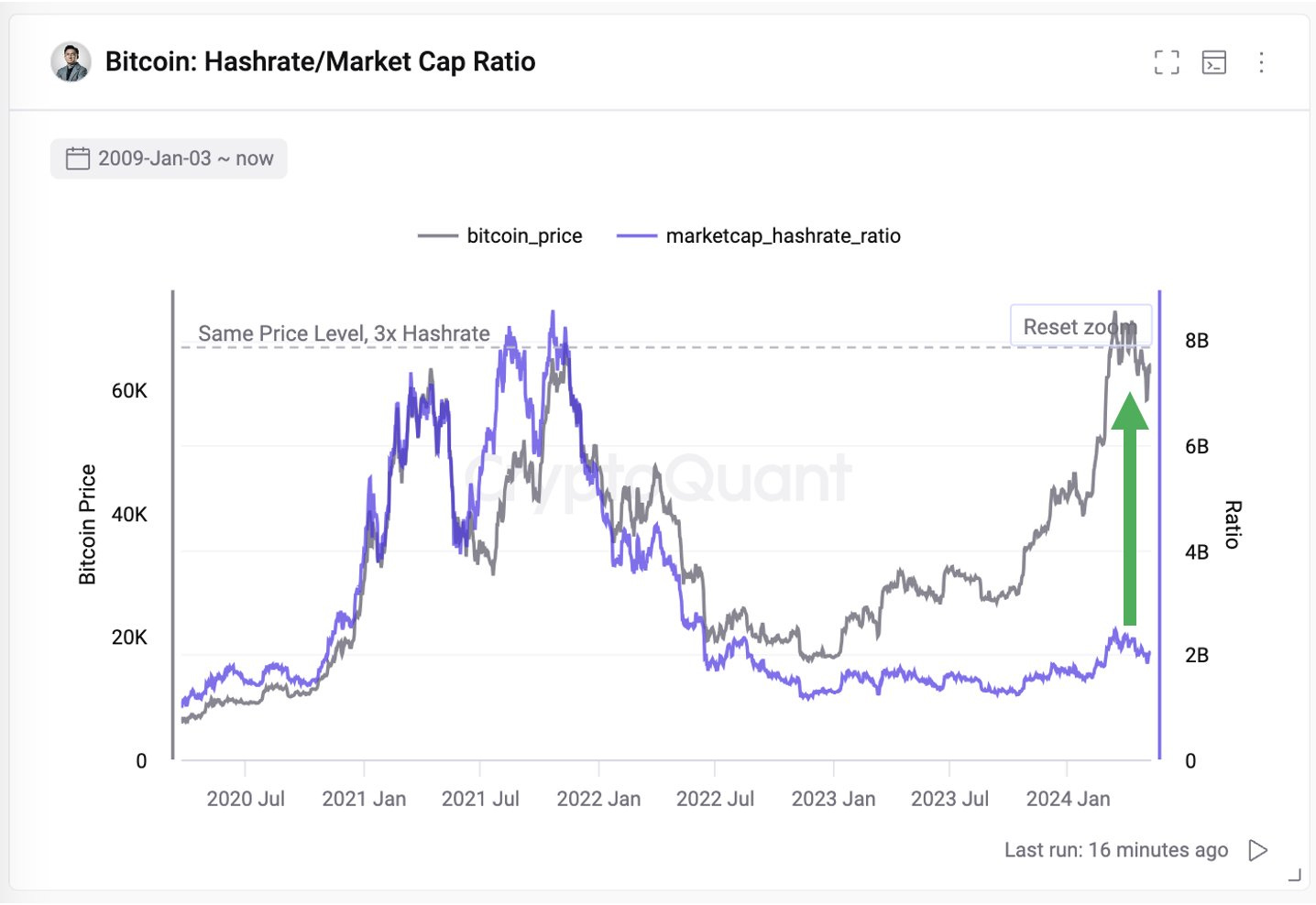

Tweet of this week —> “Bitcoin network fundamentals could support a market cap three times its current size”

Current status 100% Winning strategy: 🔵—> ALL-IN

Updated chart, shows $BTC remains in the blue all-in zone, more info:

Bitcoin

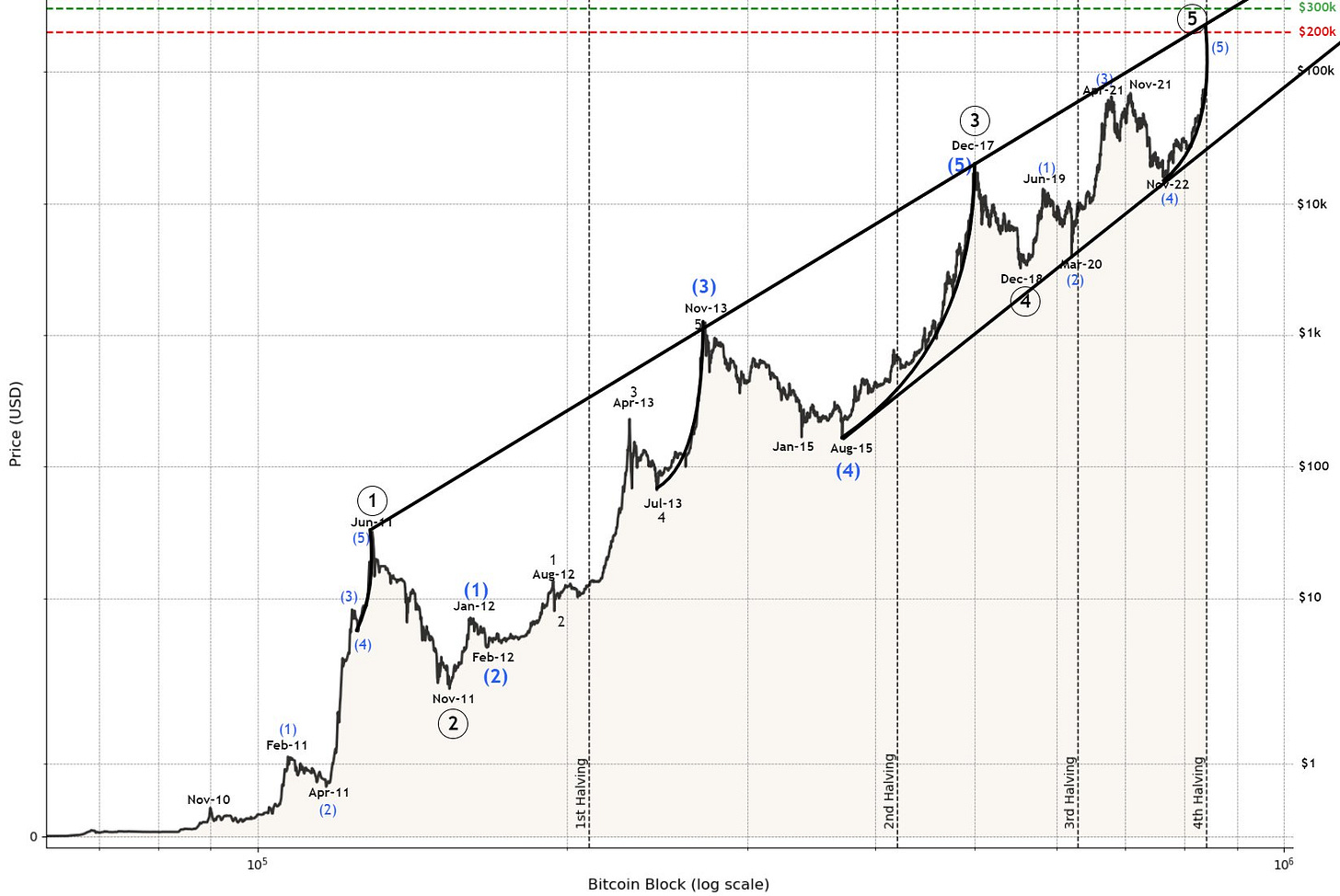

The Longterm Holders Accumulation Ratio is at a level only seen during the final phase of previous cycles.

High levels of this ratio indicate that Longterm holders are adding to sell-side pressure, distributing accumulated coins. Low values, correspond to accumulating Longterm holders.

Many are tragically failing to recognize that the current parabolic surge is not the dawn of a fresh cycle, but rather the culmination of a 15-year journey.