The information and insights are based on my knowledge; don’t take it as financial advice.

Summary

Bitcoin ready to explode

Altcoin market cap confirms breakout

ETH/BTC shows strong bullish divergence

Dollar confirms downtrend with another bearish weekly close

Key Metrics

Current status 100% Winning strategy: 🔵—> ALL-IN

a weekly candle close below $84.9k would flash the black signal.

10Y-2Y Yield Spread is well above zero

Content

BITCOIN

ALTCOINS

STOCKS

FOREX

SUPERMACRO CONTEXT (BTC/STOCKS/FOREX)

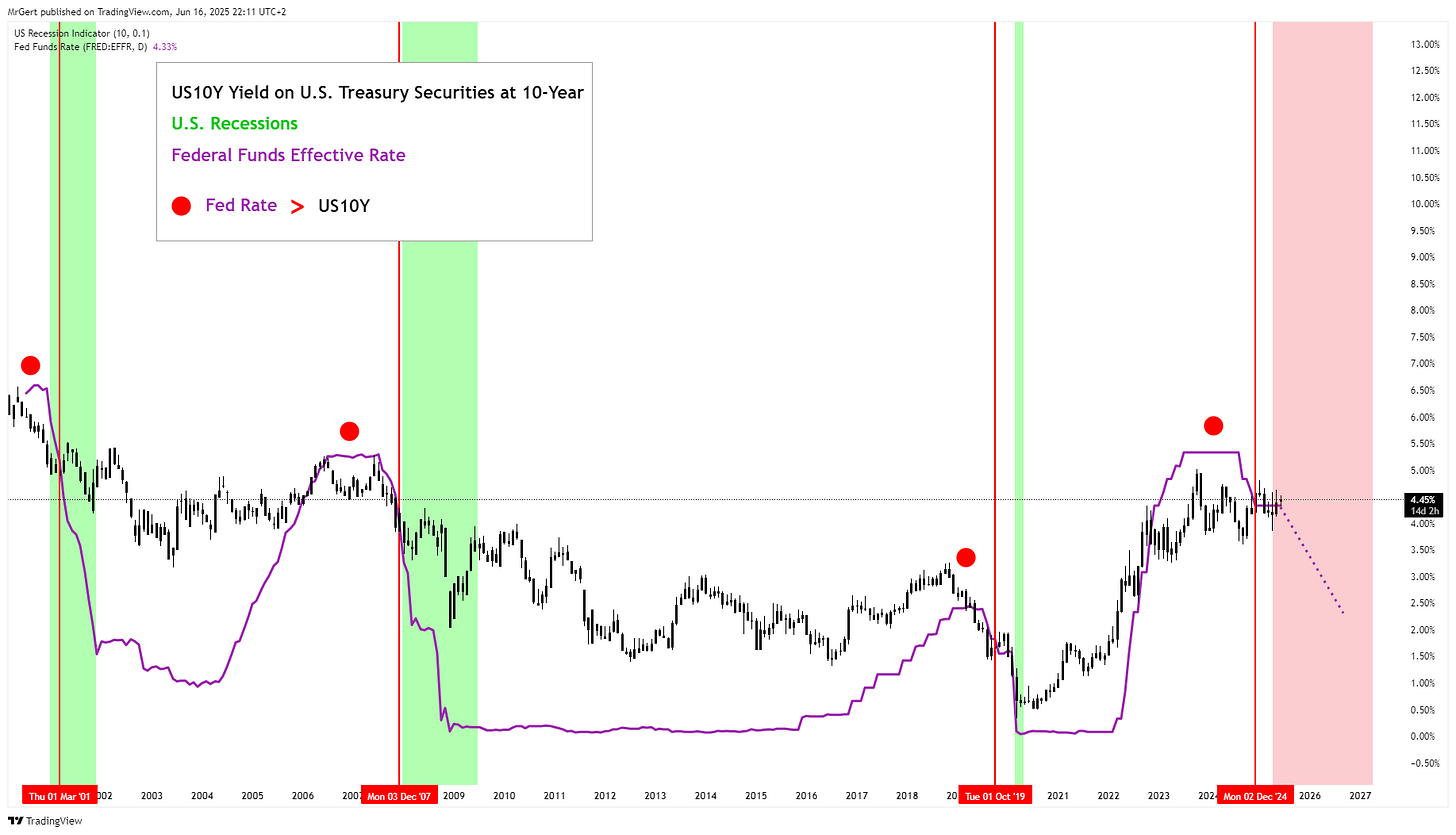

This is one of the most important charts in my opinion, so let’s start right here this week. The US10Y in black is breaking back above the Fed Rate, something we always witness during the start of a recession…

That’s why I still see the first scenario play out with an early $BTC top at $325k before mid-July.

1. BITCOIN

Last week Bitcoin has grabbed some downside liquidity. All the while a huge amount of potential liquidations >$2b have piled up at the current all-time high, see link. First Bitcoin rose on fear, now it will rise on liquidations. The peak will be characterized by a lot of long term holders starting to take profits, i.e. dormant wallets getting active again. All major top indicators are still about halfway to the peak zone (Rhodl Ratio, MVRV Z-Score, etc.).