Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

News of this week

Mt. Gox plans to initiate Bitcoin and Bitcoin Cash repayments in July, causing some baseless market fears. Under Japanese Law, similar to FTX, Mt. Gox creditors will receive $483 per Bitcoin, which translates to 0.008 BTC per BTC held originally. Thus, the $9 billion becomes a mere $72 million paid out to customers.

Representative Matt Gaetz has introduced legislation that would permit the payment of federal income taxes using Bitcoin.

VanEck and 21Shares have both submitted applications for a spot Solana ETF.

Coinbase has filed a lawsuit against the SEC and FDIC, alleging that federal regulators are attempting to exclude the cryptocurrency industry.

BlackRock claims that Bitcoin serves as a hedge against geopolitical instability and monetary risk.

Bolivia has lifted its ban on Bitcoin and crypto payments, making them officially legal for financial institutions.

Sony is set to launch a cryptocurrency exchange in Japan.

The US Marshals Service has announced a collaboration with Coinbase to secure and manage its substantial digital assets portfolio.

Circle has become the first global stablecoin issuer to receive an Electronic Money Institution license under the EU's MiCA crypto regulations.

Tweet of the week —> “Mt Gox creditors will get $483 per Bitcoin in Bitcoin.”

Current status 100% Winning strategy: 🔵—> ALL-IN

a price drop to $49.5k would flash the black signal.

Bitcoin

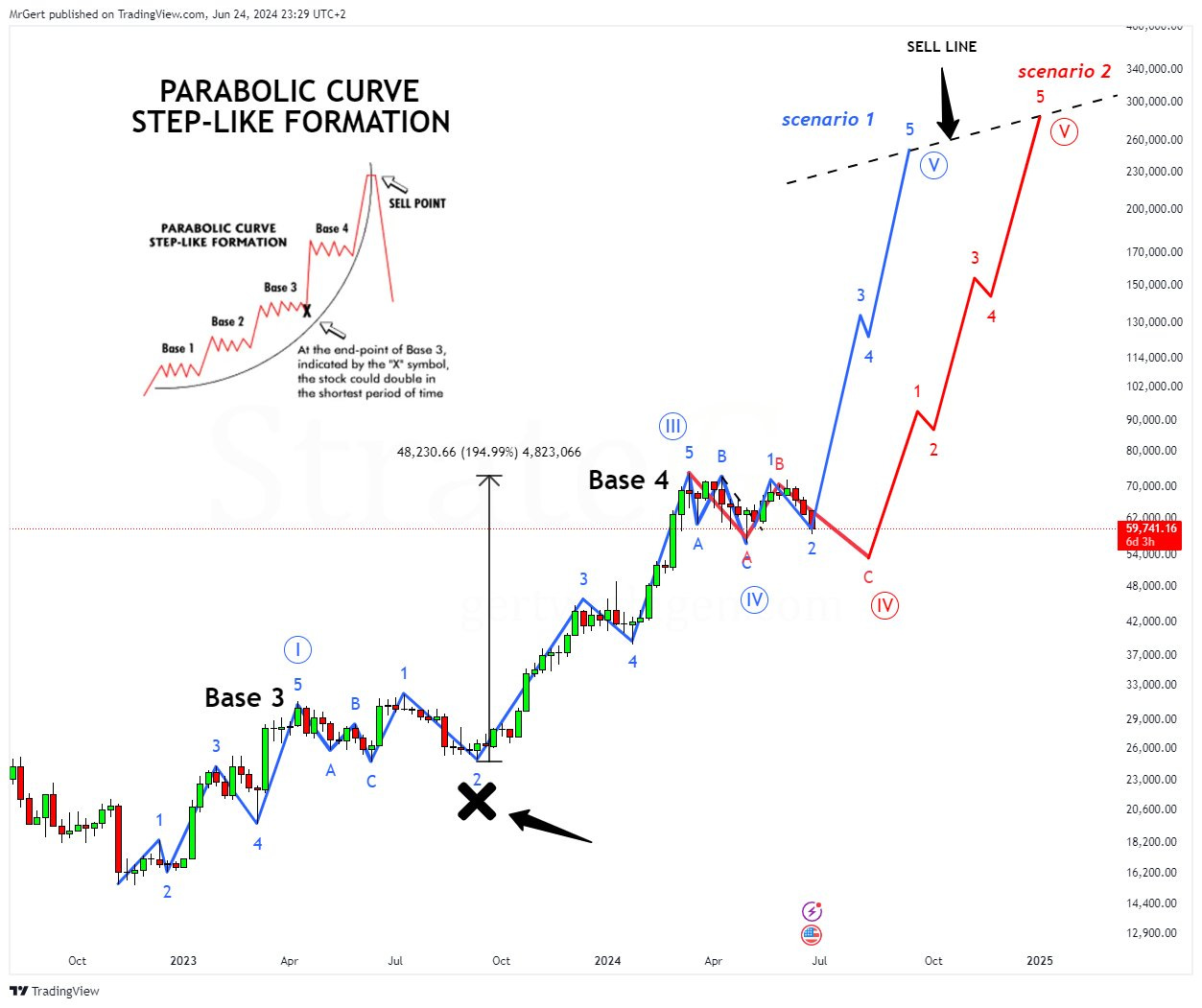

Four weeks ago the following two scenario’s were discussed. Price has not yet made a decisive move for one of the scenarios to get invalidated.

BLUE - Correction III-IV is already final, blow-off wave 5 is about to kick in. ATH needs to be broken for this. Peak target lies between ~$235k-$260k. Invalidation: $56.5k.

RED - Correction 3-4 on the right isn’t final, first another leg down is next, wave C. After that blow-off wave 4-5 kicks in. Peak target lies between ~$260k-$330k. Validation: $56.5k.

On a higher timeframe those two scenarios make sense as well.

In the first (BLUE) scenario the handle of the giant Cup with Handle pattern formed is final already. A big impulsive blow-off burst breaking beyond $200k is to be expected next.

In the other (RED) scenario, the handle isn’t final yet. The last and final wave within can reach a bit below $56k. In this case the handle itself can act as a busted double top pattern. Price shouldn’t drop below $49.5k in order to not enter bearish territory and invalidating a move to $200k+.