Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

News of last week

Standard Chartered Bank, managing $820 billion in assets, predicts Bitcoin could hit $100,000 by August.

Riot Platforms, the largest Bitcoin miner in the U.S., boosts its hash rate by 50% in one month.

Tron founder Justin Sun proposes purchasing all Bitcoin held by the German government to reduce market impact.

According to the Financial Times, Donald Trump's potential election could trigger a Bitcoin rally in the latter half of the year.

Tweet of the week —> “The market has too much paper in the system. Despite heavy long liquidations, we are seeing more longs coming in to replace them, preventing a proper reset. Chart: Open Value Oscillator... OV is a measure of how many bets are in the system, denominated in BTC.”

Current status 100% Winning strategy: 🔵—> ALL-IN

a price drop to $49.6k would flash the black signal.

Bitcoin

Long-term holders are still in the green 'Belief' zone, while short-term holders are capitulating for the zillionth time this cycle. Historically, when the NUPL was at current levels, it was right before the 'banana phase' in which long-term holders went fully euphoric (blue).

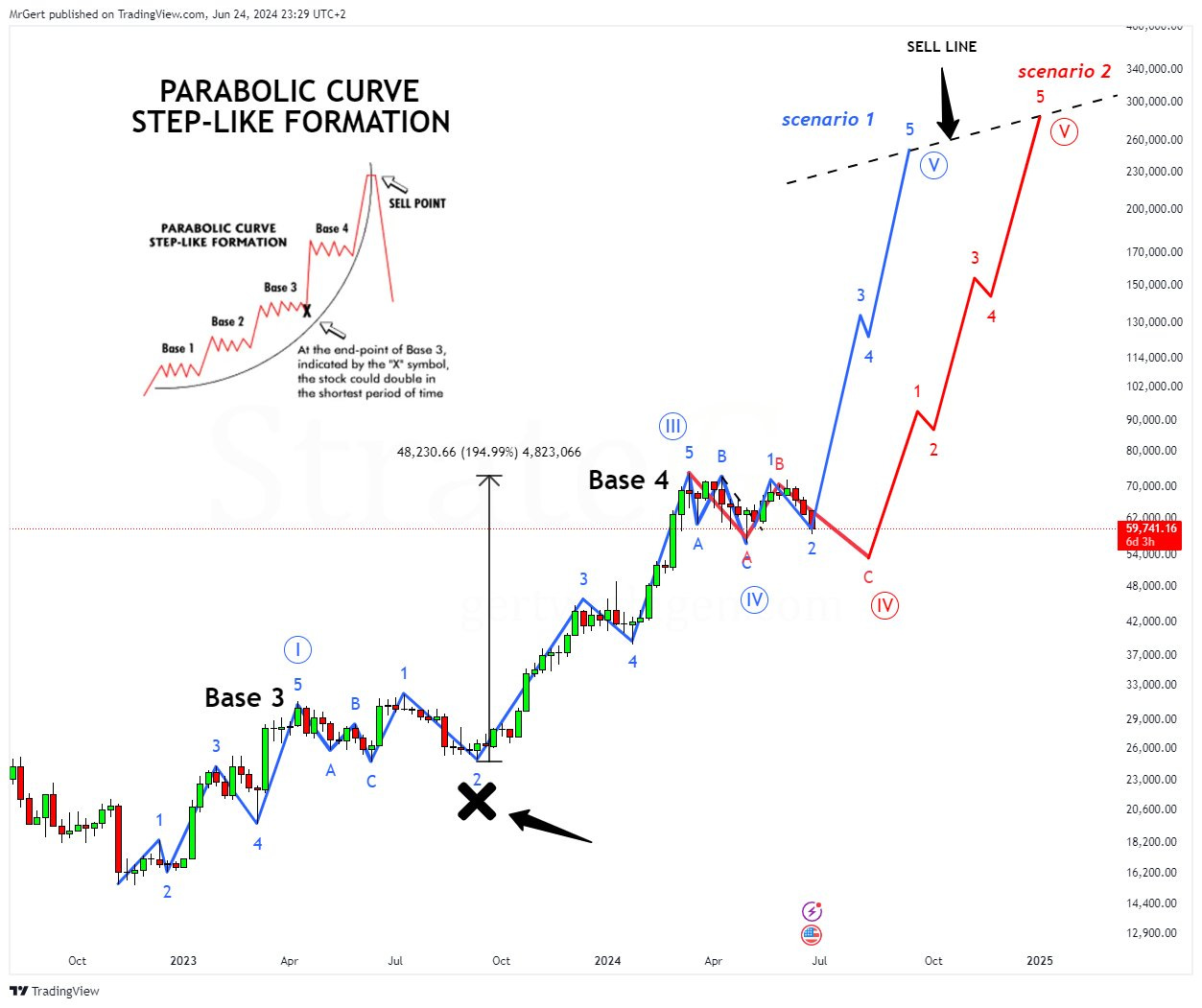

Five weeks ago the following two scenario’s were discussed. Price has made a decisive move for the red scenario by closing a weekly candle below the $56.5k

RED - Correction 3-4 on the right isn’t final, first another leg down is next, wave C. After that blow-off wave 4-5 kicks in. Peak target lies between ~$260k-$330k. Validation: $56.5k.

Now the handle itself can act as a busted double top pattern, once breaking back above $60k. Price shouldn’t close a weekly candle below $49.6k in order to not enter bearish territory and invalidating a move to $200k+.