The information and insights are based on my knowledge; don’t take it as financial advice.

News

Elon Musk updates his X profile picture to include laser eyes.

Cboe confirms the launch of five Spot Ethereum ETFs on July 23 by VanEck, Invesco, Fidelity, 21Shares, and Franklin Templeton.

Senator Cynthia Lummis highlights Bitcoin's resilience to widespread cyber outages.

Stripe enables European customers to buy Bitcoin and other cryptocurrencies with credit or debit cards.

Trump names pro-crypto senator JD Vance as his VP running mate.

Trump considers JPMorgan CEO Jamie Dimon for Treasury Secretary, noting Dimon's changed stance on Bitcoin and crypto.

Trump, aiming to maintain US leadership in Bitcoin and crypto, also considers BlackRock CEO Larry Fink for Treasury Secretary, according to NYPost.

Senator Menendez convicted of accepting bribes in gold and cash. In 2017, he labeled Bitcoin as "an ideal choice for criminals."

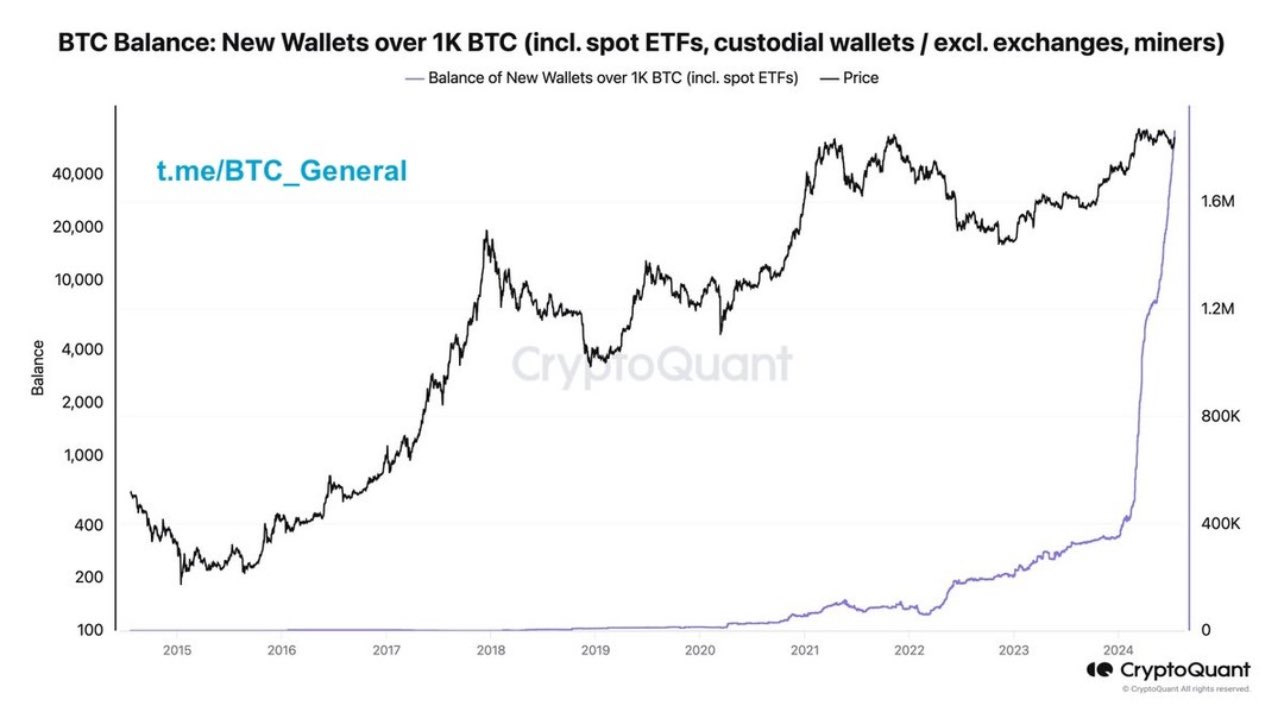

Tweet of the week —> “Institutions and whales are buying Bitcoin like never before.”

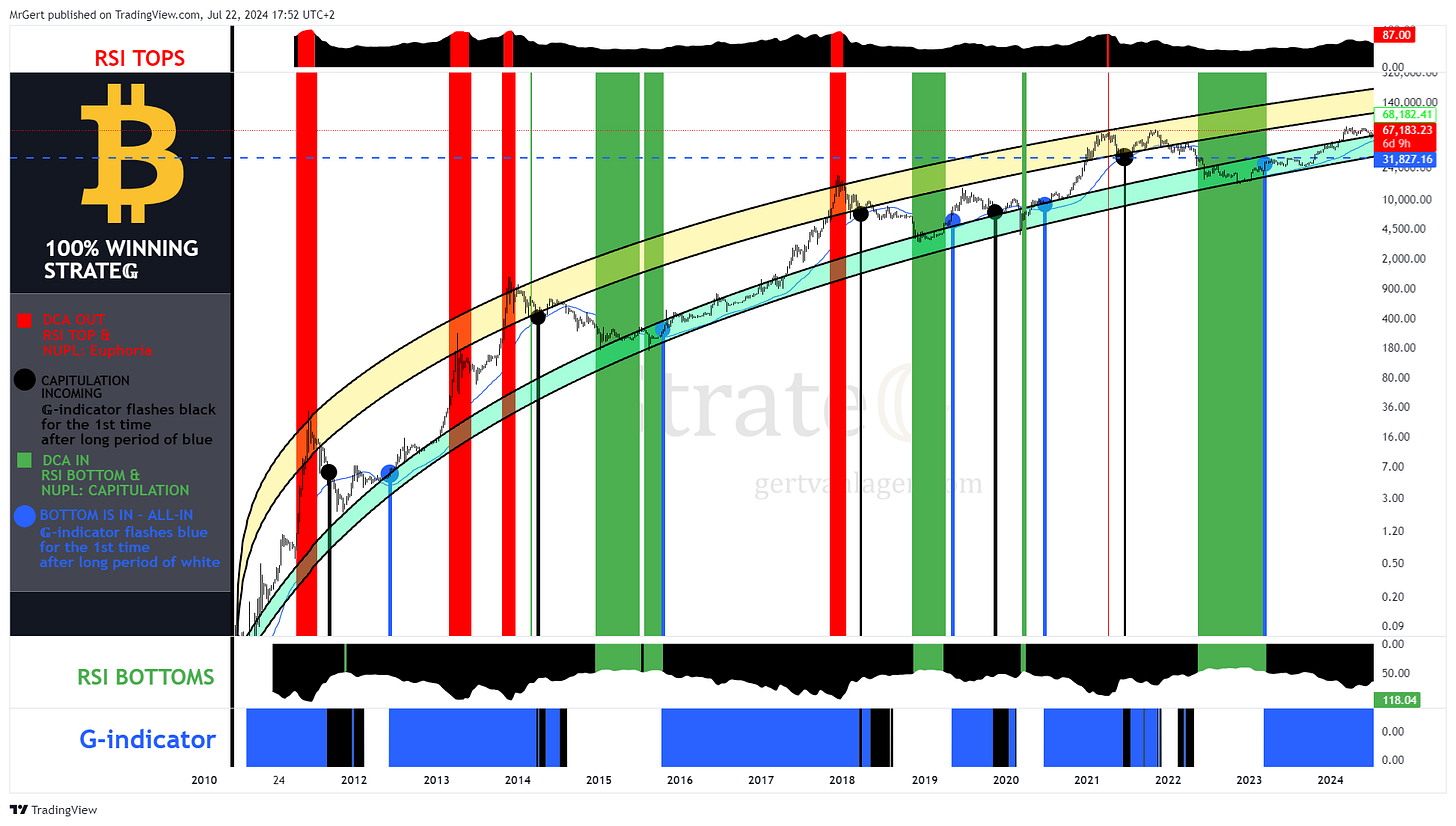

Current status 100% Winning strategy: 🔵—> ALL-IN

a price drop to $51.5k would flash the black signal.

Despite concerns surrounding Evergrande, Ukraine, and Federal Reserve rate changes, I have consistently maintained that these events were not the triggers for a stock market recession in 2021 and 2022. A significant blow-off top (a 5-wave pattern) reaching the 100-year signal line at 5500-6000 for the S&P 500 was necessary first.

Now, with the lower bound reached and the blow-off top nearing its final stage, it is time to monitor for high timeframe bearish distribution signals, which typically precede a major recession.

In the coming period, I expect lower-cap stocks and cryptocurrencies to experience their own blow-off phases, while the S&P 500 starts showing high timeframe bearish signals, such as bearish divergence while reaching a series of all-time highs. Markets often peak simultaneously before a recession.

The Federal Reserve is likely to start cutting rates in September, following a long period of hikes and pauses. Historically, this rate-cutting aligns with the distribution phase before a recession for stocks. Yield spread inversions have indicated an imminent recession for over two years and are now beginning to reverse. The short-term outlook for the bond market (2-3 years) remains uncertain.

Finally, it is important to note that U.S. elections do not guarantee protection against a recession, as evidenced by the years 2000 and 2008.

Bitcoin

Cup and Handle structures show that the altcoin market cap (ALTCAP) is lagging behind Bitcoin, which is in turn lagging behind the Nasdaq-100. Bitcoin is positioned for a significant catch-up, with altcoins expected to experience an even greater surge. Historically, the cycle peaks of these markets tend to align.

Bitcoin (BTC) against the M1 money supply has bounced off the trend line of a 6.5-year inverse Head & Shoulders pattern after successfully testing it twice on the 2-week chart. This relationship highlights Bitcoin's performance relative to the money supply, indicating its potential as a hedge against inflation and currency devaluation. The successful tests and subsequent bounce suggest a strong bullish sentiment and potential for significant upward movement in the context of the broader financial environment.