Strate𝔾 Update - Week 33 | Q3 | 2024

BOUNCE after leveraged trades are flushed out of the system.

The information and insights are based on my knowledge; don’t take it as financial advice.

News

Celsius files a lawsuit against Tether, seeking $2.4 billion in Bitcoin.

U.S. credit card debt hits a record high of $1.14 trillion.

Donald Trump warns of an impending economic crisis, likening it to the 1929 crash, predicting a depression, and cautioning about the potential for a new world war.

Russia officially sanctions Bitcoin and cryptocurrency mining.

JPMorgan estimates the likelihood of a U.S. recession at 35% by the end of the year.

Judge concludes Ripple's $XRP is not a security, ordering the company to pay $125 million in civil penalties, effectively ending the SEC lawsuit.

Michael Saylor discloses personal Bitcoin holdings exceeding $1 billion.

Morgan Stanley advisors set to offer clients access to spot Bitcoin ETFs starting August 7th, managing assets worth $1.3 trillion.

Tweet of the week —> “I'm pretty sure something is happening behind the scenes..”

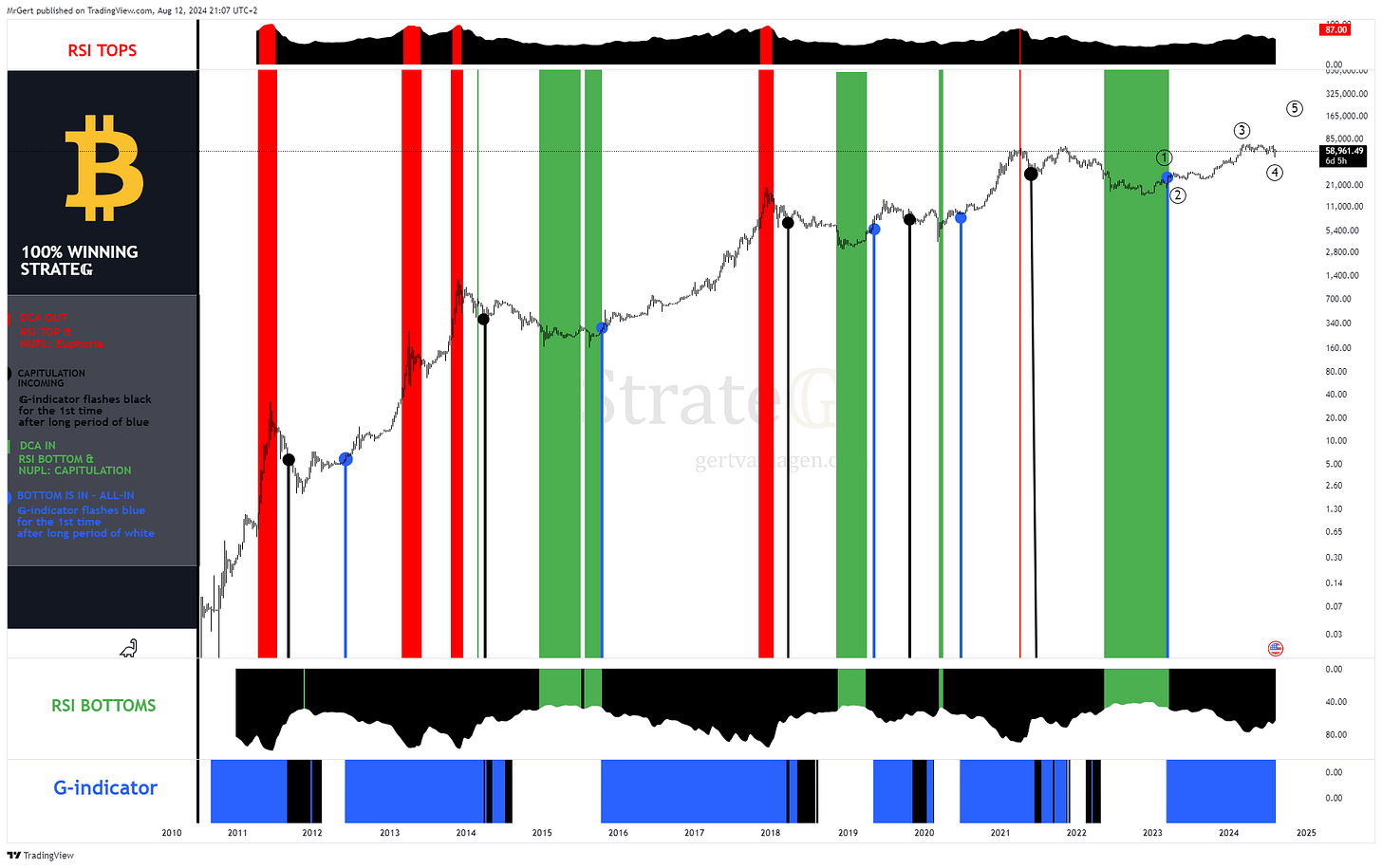

Current status 100% Winning strategy: 🔵—> ALL-IN

a weekly candle close below $52.8k would flash the black signal.

Bitcoin

During last week’s global market crashes, Bitcoin has tested it’s bull market support at $50k (0.786 Fib. level). Given the fact price has printed a local lower low, it’s clear price is still within the iii-iv correction and the anticipated final blow-off wave iv-v hasn’t started yet.

Invalidation for wave iv-v to play out lies at $31.8k. Based on historical data a fifth wave seems unlikely whenever price closes two Fibonacci levels lower, in this case a close below $40k. Also a weekly close below the $52.8k price level would complicate things for a swift recovery and expansion to $200k.

Notice how wave iii-iv now qualifies as a descending broadening wedge, comparable to the correction containing the COVID-dip [(1)-(2)].