Strate𝔾 Update - Week 43 | Q4 | 2024

Gold surges, risk-on remains, BTC heads to ATH after break-out.

The information and insights are based on my knowledge; don’t take it as financial advice.

News

Contributions to U.S. presidential campaigns through cryptocurrencies have exceeded $190 million.

Gold sets a new record, achieving its highest price ever.

BRICS nations plan to adopt digital currencies for investment transactions.

DBS, Singapore's largest bank, unveils blockchain-based token services to enhance its banking capabilities.

Morgan Stanley, managing $1.3 trillion in assets, reveals $272 million in Bitcoin ETF investments.

Bank of America cautions that gold may remain the ultimate safe haven as U.S. Treasury bonds face threats from escalating national debt.

The FBI apprehends the individual responsible for hacking the SEC’s Twitter account and spreading false information about a Bitcoin ETF approval.

Goldman Sachs predicts the Federal Reserve will reduce interest rates to 3.25%–3.5% by mid-2025.

Italy plans to increase the capital gains tax on Bitcoin from 26% to 42%.

Standard Chartered Bank forecasts Bitcoin could break new records before the 2024 U.S. presidential election.

Neel Kashkari of the Federal Reserve continues to dismiss Bitcoin, maintaining that it holds no value after more than a decade.

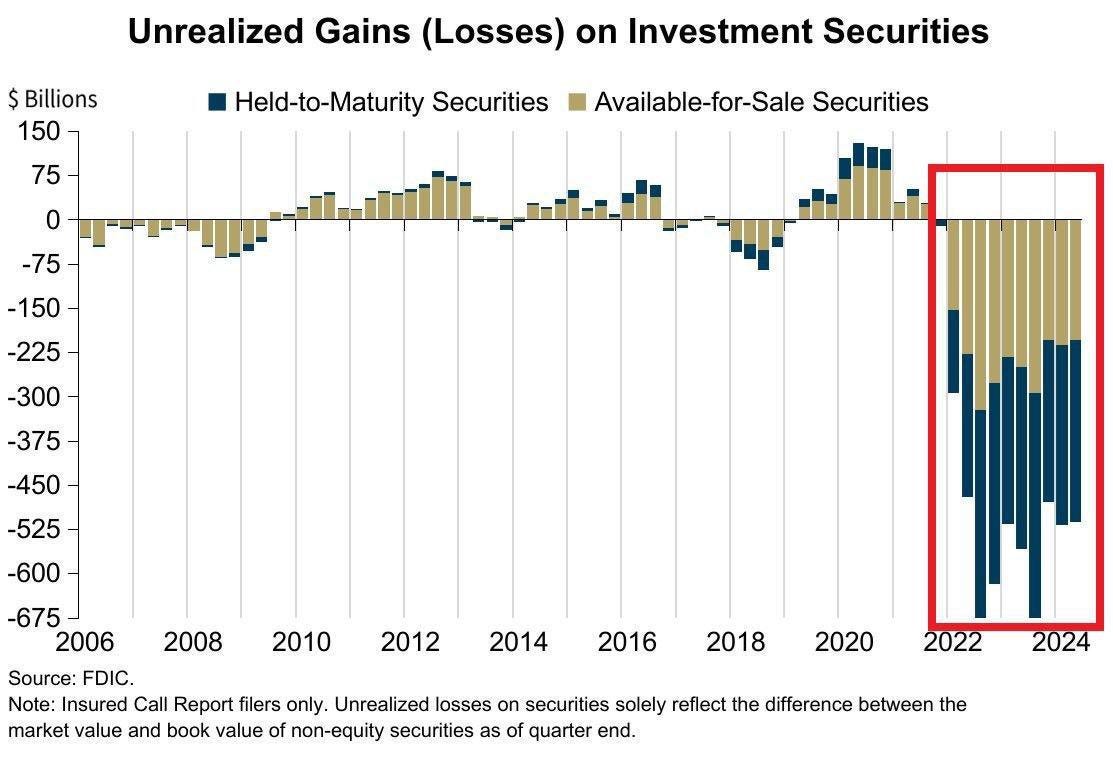

Unrealized losses at U.S. banks are now seven times higher than those seen during the 2008 financial crisis.

BlackRock is reportedly in discussions with several global crypto exchanges, including Binance, to utilize the BUIDL token as collateral for futures contracts.

Tweet of this week: “Watching #Bitcoin pump while you’re at work knowing you won’t stay there forever”

Current status 100% Winning strategy: (🔵)—> (ALL-IN)

a weekly candle close below $58.3k would really flash the black signal.

Risk-On Warning: First Blow-Off incoming!

The Yield spread (10-2Y) has reversed well back above zero after staying below for over 2 years. With the FED rate now really cut strongly, indicators are lining up in a prerecession formation.

Similar patterns preceded a recession within 6 months in the past, but ignited a final rally first. After that? Sharp collapse. Compare it yourself in the chart below.

Bitcoin - Falling Broadening Wedge - Update

Bitcoin (BTC) has broken out of the 7-month descending broadening wedge pattern last week and is currently retesting the upper trend line for support.

Historically, a falling broadening wedge within an uptrend has a 79% probability of breaking to the upside. Additionally, there has been a strong rebound off the 40-week simple moving average (SMA) band, further supporting a potential upward move.

As long as the price closes the week above the 58.3k level, the 4-5 wave shown below will likely be confirmed by surpassing the ATH set earlier this year. It's evident that the price is still in the iii-iv correction phase, with the exciting final blow-off wave iv-v yet to begin.