Strate𝔾 Update - Week 46 | Q4 | 2024

Bitcoin in full price discovery; altcoins slowly gearing up too

The information and insights are based on my knowledge; don’t take it as financial advice.

News

$725B Bernstein recommends investors to add crypto exposure immediately.

Ethereum’s market cap reaches $365B, surpassing Bank of America’s $345B.

VanEck CEO estimates BTC could eventually reach half the mcap of gold ~$300k.

Germany’s sale of 50,000 Bitcoin at $54K led to $1.1B in missed profit potential.

BlackRock’s Bitcoin ETF now exceeds the size of its Gold ETF.

Detroit becomes the largest U.S. city to accept crypto for tax payments.

President Putin states that Russia will continue using the U.S. Dollar.

The Federal Reserve lowers interest rates by 25 basis points.

Over 250 pro-crypto candidates win seats in Congress, according to Fox Business.

U.S. Senator Cynthia Lummis announces plans to create a national BTC reserve.

Chinese media reports Trump’s intentions make the U.S. a global leader in crypto.

JPMorgan predicts BTC and gold will benefit from Donald Trump’s re-election.

Donald Trump officially elected President of the United States.

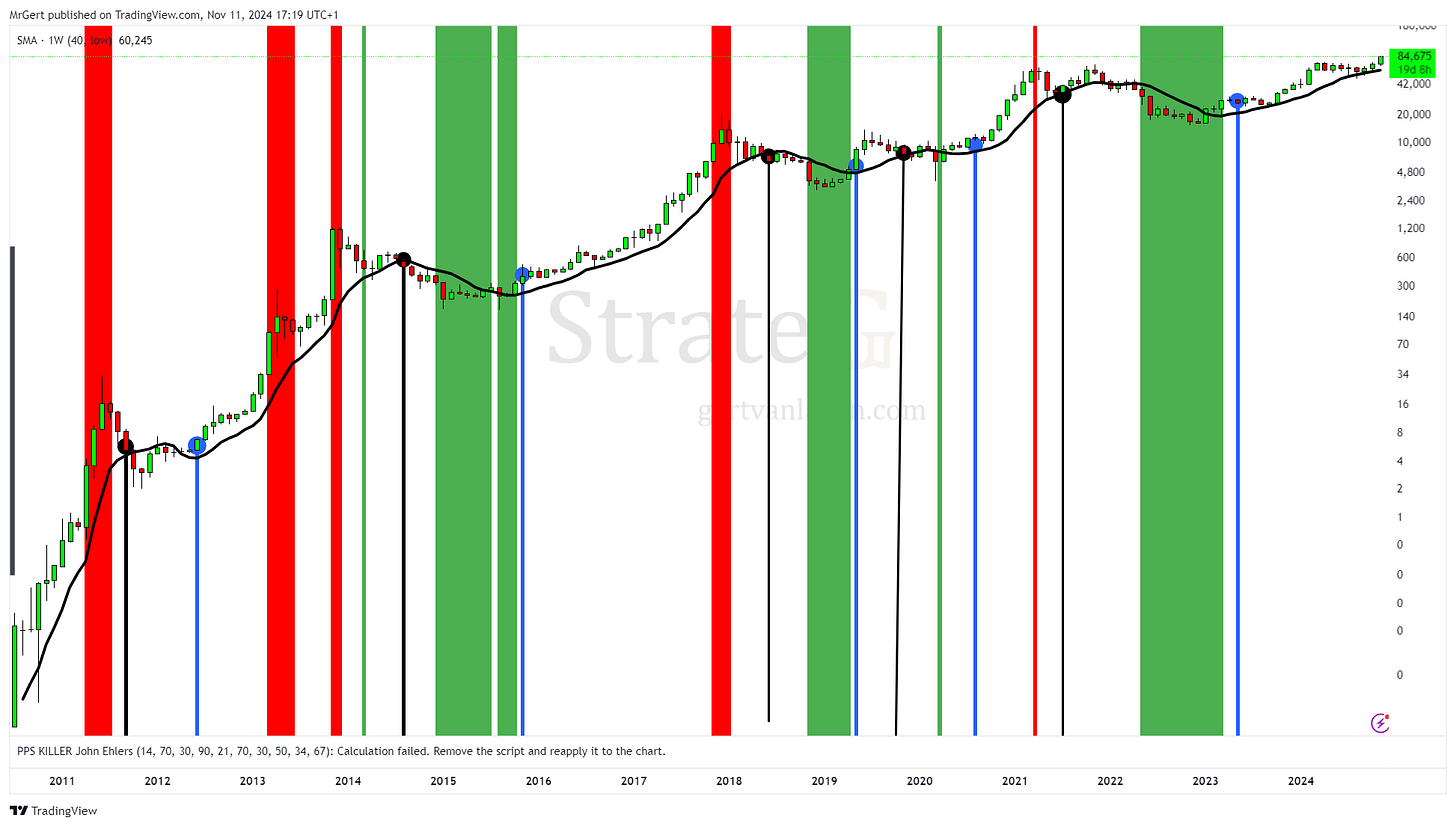

Tweet of this week: “#BTC targets need to be determined on the log chart!”

Current status 100% Winning strategy: 🔵—> ALL-IN

a weekly candle close below $60.2k would flash the black signal.

Risk-On Warning: First Blow-Off incoming!

The Yield spread (10-2Y) has reversed well back above zero after staying below for over 2 years. With the FED rate now cut again, indicators are lining up in a pre-recession formation.

Similar patterns preceded a recession within 6 months in the past, but ignited a final rally first. After that? Sharp collapse. Compare it yourself in the chart below.

Bitcoin - Cascade of ATH’s

With Bitcoin at $85k level, price is finally breaking out of the Re-accumulation phase (Diverging Broadening Wedge). This strong upswing in momentum has been only seen during the steepest historical price expansions of BTC.

Bitcoin has printed an ATH and is already in price discovery way beyond the $74k level. The 4-5 wave as shown below is strongly confirmed and the 3-4 correction phase is finally left behind. The exciting final blow-off wave 4-5 has started.

The Elliott wave has been fully confirmed now and there’s no way to invalidate it any more. $31.8k keeps being an important price level as a drop below it will show the fifth wave is final.

Roughly two scenarios remain to play out between now and EOY-’25:

Due to an imminent recession (probably within 5 months), $BTC has a blow-off wave priorly, or prints a truncated wave 5 slightly above the current ATH;

The 4-year cycle plays out and price tops EOY-’25;

Macro Elliott wave count (2009 - )

When zooming out the most possible, everything adds up to target the $200-$300k:

Target of the Cup with Handle (green);

Wave (4)-(5) needs a final leg up to contain five subwaves itself;

Aligns with trend line through ① and ③ → to project target of ⑤ (Elliott wave channeling principle).

Altcap - update

ALTCAP excluding $ETH (TOTAL3) is forming a strong Cup with Handle bottom reversal pattern as well. It has broken through the upper trend line of the handle and has successfully tested it for support. It also shows this Head and Shoulders bottom targeting the ~$2T altcap, which will likely only be the beginning, read further…

As usual the altcap is lagging a little w.r.t. $BTC and $ETH, but tends to peak simultaneously with the aforementioned cryptos, hence sooner or later a huge catch-up sprint is to be expected.

With BTC dominance at 50%, TOTAL3 is possibly eyeing a market cap around $4 trillion (7x increase) if BTC reaches $250k (4x increase).

This target aligns perfectly with the double target of the Cup & Handle pattern currently in play.

Notice how precisely the double target from the 2019-2020 double bottom aligns with the cycle top (11x increase)! 🚀

Stocks - update

→ Supermacro Context

The S&P 500 has hit the wonderful 6000 level and the Cup & Handle pattern identified in 2022 has almost fully played out now.

Stocks are bursting out violently in 2024 as anticipated in this newsletter last year. The target of the SP500 Cup and Handle lies around 5800-6000 and the index is halfway through at this moment. These low timeframe targets align with the trend through the tops before Great Depression (1929, -85%) and Dotcom bubble (2000, -40%), see Supermacro Context.

On the 6-month timeframe the SP500 has entered the target zone of 5600-6000:

The higher uptrend has been hit, similar to occurrences in 1929 and 2000, both of which were followed by a recession.

The Elliott wave count also indicates a potential steep correction in the near future.

When using the wicks in the figure below at I and III, the projection of V lies still a bit higher at around 6000. Hence there’s (little) room left to the upside before a recession is likely to kick in.

What is it?

The S&P 500 is composed of 500 large-cap companies, chosen for their market capitalization, liquidity, and industry representation. These companies span various sectors, including technology, healthcare, finance, and more.

How is the index calculated?

The index is market-capitalization-weighted, meaning that larger companies have a greater impact on the index's value. The current weighting table can be found here, or see snapshot below (e.g. AAPL has a weight of 9.479).

Why is it relevant?

Changes in the S&P 500 are closely monitored as an economic indicator. The index is considered reflective of overall market sentiment and economic trends in the United States, being the largest economy, globally.

DXY - US Dollar Index

DXY is finding resistance within the LTF resistance zone and has formed a descending triangle, which is a bearish continuation pattern. The dollar index still seems ready to break down from the double top formation (Jul-2023 - Now), which is now transforming into a triangle structure, targeting sub 95.

Important to note is that sixty-five weeks ago, the US Dollar experienced a significant downturn, which took it to its lowest point in 14.5 months, a strong sign of weakness.

The US Dollar appears unable to maintain its position above the low-timeframe resistance zone highlighted in red and has closed a strong bearish candle below the red uptrend. It has yet to establish a macro higher high within the blue zone, which would signal a shift to bullish territory. As such, the anticipated direction for continuation remains downward.

It remains imperative to monitor whether the US Dollar can sustain its newly achieved higher levels or if the resistance met is too strong, potentially even leading to a lower low, invalidating the quest for a bullish reversal.

At the moment, the dollar and $BTC do not seem to be much correlated on lower timeframes. Roughly speaking the dollar is in a downtrend since EOY’23, and $BTC in an uptrend ever since.