Strate𝔾 Update - Week 51 | Q4 | 2024

Direct continuation beyond $100k; alts ready to surge dramatically

The information and insights are based on my knowledge; don’t take it as financial advice.

News

Texas Considers Strategic Bitcoin Reserve: Texas State Representative Giovanni Capriglione officially files a bill proposing the establishment of a strategic Bitcoin reserve for the state.

Ripple to Launch RLUSD Stablecoin: Ripple receives final approval from the New York Department of Financial Services (NYDFS) to launch its RLUSD stablecoin, set for release on December 17.

Goldman Sachs Eyes Cryptocurrency Markets: Goldman Sachs, managing $3 trillion in assets, states it will evaluate participation in Bitcoin or Ethereum markets if regulatory conditions allow.

BlackRock Endorses Bitcoin Allocation: BlackRock suggests that allocating up to 2% of a portfolio to Bitcoin is within a reasonable range.

Russia Proposes Bitcoin Strategic Reserve: Russian State Duma Deputy Anton Tkachev proposes the creation of a strategic Bitcoin reserve for the country.

China Shifts Monetary Policy: China announces plans to ease monetary policy to a "moderately loose" stance for the first time since 2010.

US Inflation Rises to 2.7%: Inflation in the United States increases to 2.7%.

Current status 100% Winning strategy: 🔵—> ALL-IN

a weekly candle close below $64k would flash the black signal.

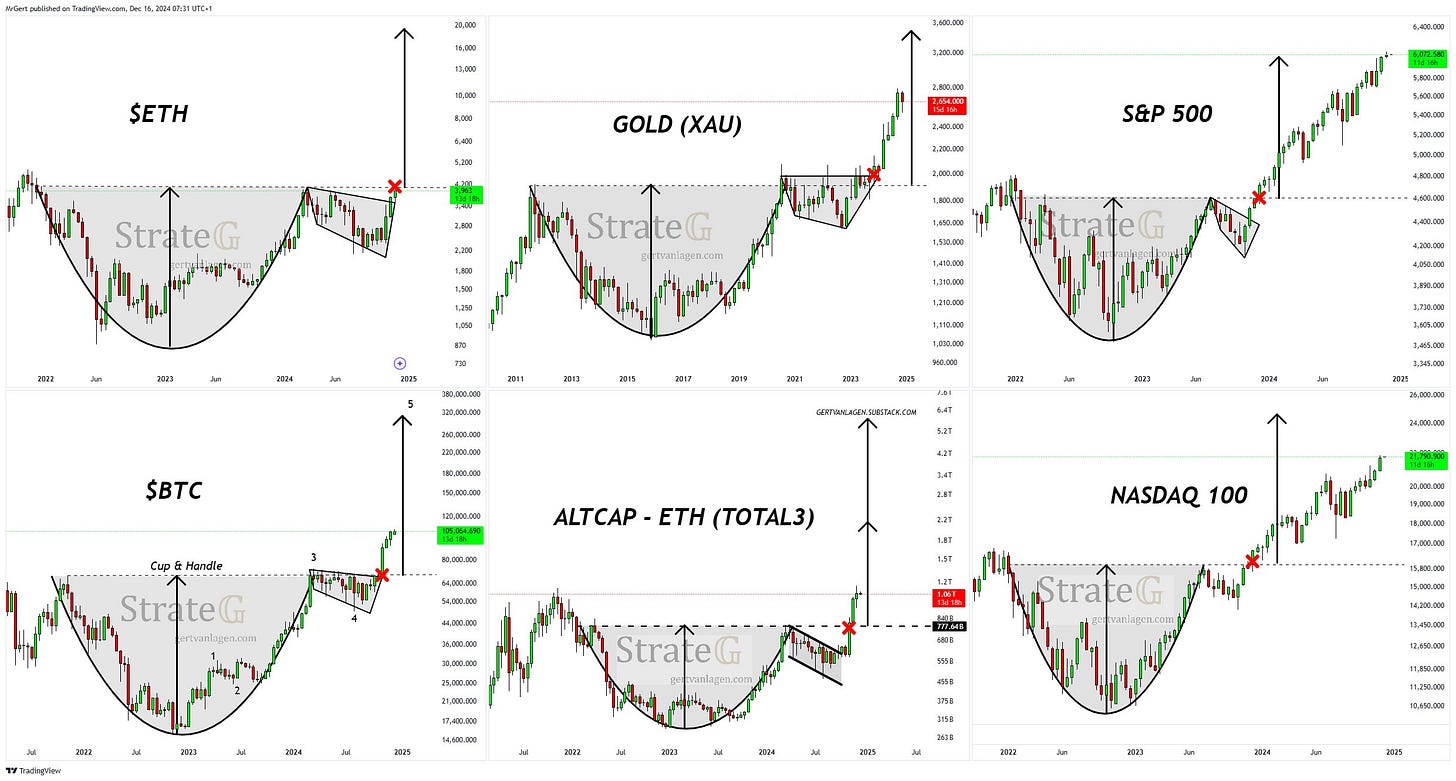

$BTC has broken the psychological resistance of $100k, closely aligning with the 1.272 extension of the 2018 bear market (technical resistance). As there is little time left before a recession kicks in, Bitcoin seems to follow the direct continuation path beyond $100k, without much of a rejection on a higher timeframe, similar to the $10, $100 and $10k cases.

The market has shifted fully into RISK-ON mode. While the S&P 500 is moving sideways, the tech-focused NASDAQ 100 is rallying as anticipated in last newsletters. ETH is poised to break out, following BTC's lead. Meanwhile, central banks and governments are accumulating gold, signaling a flight to safety to lock in gains and/or prepare for a recession. This marks the final pre-recession surge for risk-on assets, as the increasing threat of a recession makes exposure to volatile assets increasingly perilous.