The information and insights are based on my knowledge; don’t take it as financial advice.

News

MicroStrategy acquires 5,262 Bitcoin, spending $561 million.

Fewer than 7% of people worldwide have invested in crypto.

MetaMask broadens its US crypto card pilot, enabling wallet payments.

France's Groupe BPCE to offer crypto investment services to 35M users.

SEC greenlights Hashdex's Bitcoin & Ethereum ETF for Nasdaq.

El Salvador plans to speed up Bitcoin purchases for its reserves.

Marathon Digital buys 15,574 BTC, valued at $1.53 billion.

Federal Reserve Chair Powell says a recession has been avoided. He forecasts another strong year but notes inflation could take 1-2 years to hit 2%. Powell confirms the Fed cannot own Bitcoin. Rates cut by 25bps.

Deutsche Bank is developing a Layer 2 blockchain on Ethereum, Bloomberg reveals.

Ohio lawmaker proposes a state Bitcoin reserve.

Ripple launches its new stablecoin, RLUSD.

Current status 100% Winning strategy: 🔵—> ALL-IN

a weekly candle close below $65.6k would flash the black signal.

The market experienced a significant dip this week, driven by the hawkish Federal Reserve's decision to cut rates by another 25 bps. This led to a spike in the 10Y-2Y Yield Spread. However, the Yield Spread has since recovered somewhat, and markets have rebounded. This serves as an early indicator of a potential incoming recession.

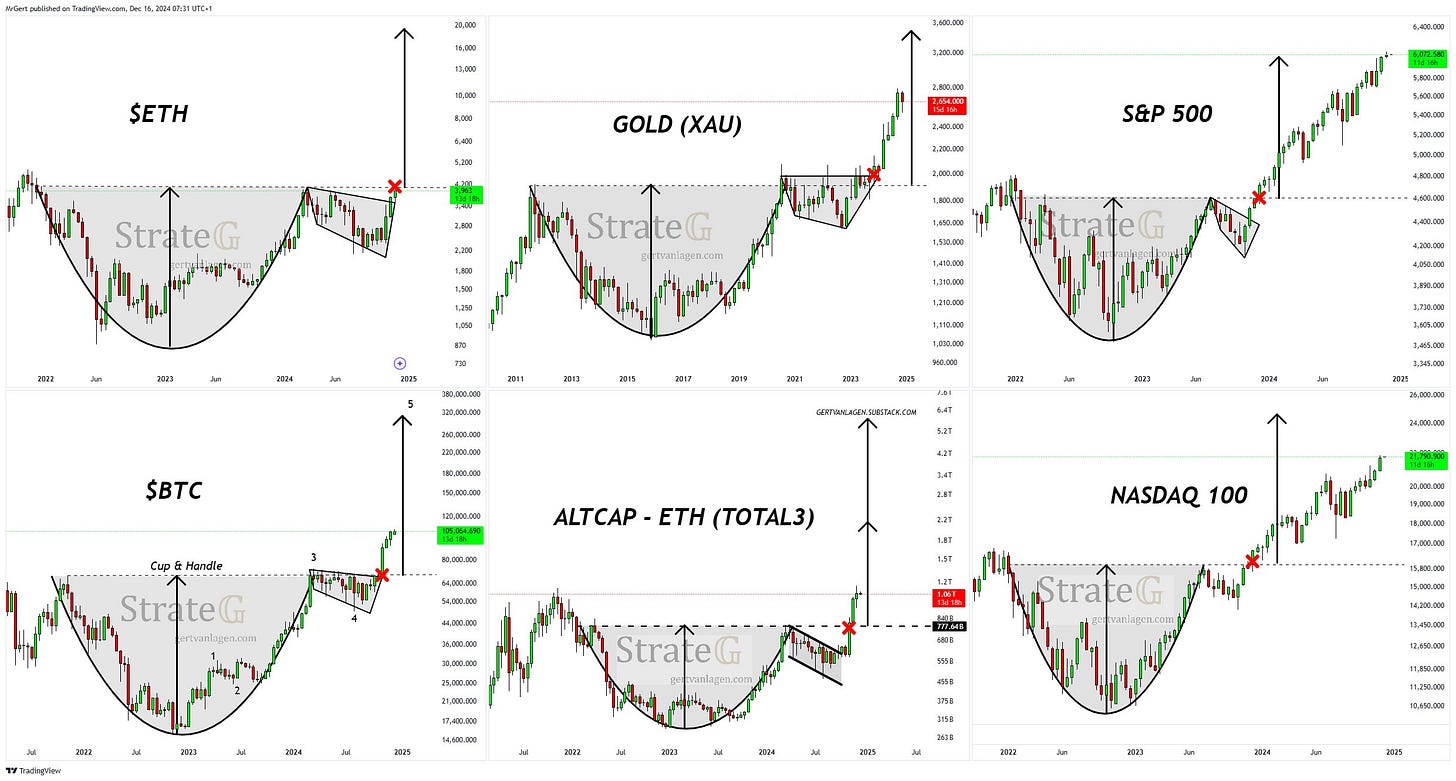

With the S&P 500 having peaked and risk-on markets rallying, a sharp 30-50% correction is quite common.

Refer to the figure below: the cycle for altcoins is only just beginning, while larger-cap markets have already peaked. Bitcoin has been holding steady around the $100k level, maintaining its strength despite the broader market dip.