Please note that while I can provide information and insights based on my knowledge, it's important to remember that I cannot offer specific financial advice. #nfa

Strate𝔾 Channel update January: LINK TO YOUTUBE

Key take aways

Alts are gearing up to follow BTC’s lead.

Both S&P 500 and Nasdaq-100 printed new ATH’s this week and had a strong weekly close.

I'd love to hear your thoughts or any suggestions you have for this newsletter! What rabbit hole should be explored in the next release?

News of this week

Anticipated crypto and stablecoin regulations are expected to be unveiled by the UK within the next six months.

Terra's Do Kwon faces extradition to the US.

Nvidia's Q4-23 revenue stands at $22.1 billion, exceeding expectations by 7.28%. This result led to a historic single-day market value increase of $277 billion for Nvidia, pushing its market capitalization beyond $2 trillion and driving an overall stock market rally.

The European Central Bank asserts that Bitcoin's fair value remains zero and cautions against its use as a payment method or investment.

Nigeria enforces restrictions on major crypto exchanges such as Kraken, Binance, and Coinbase, blocking access to their services.

Reddit discloses its investment of excess cash into Bitcoin and Ethereum, signaling potential ongoing investments in these cryptocurrencies.

Grayscale's CEO expresses confidence that a spot Ethereum ETF will come to fruition, stating it's a matter of "when," not "if."

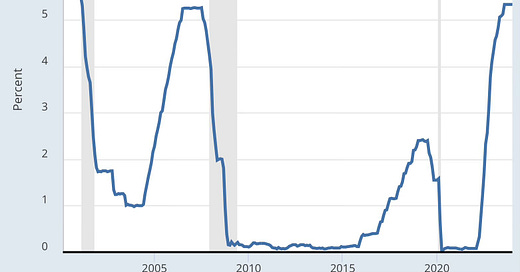

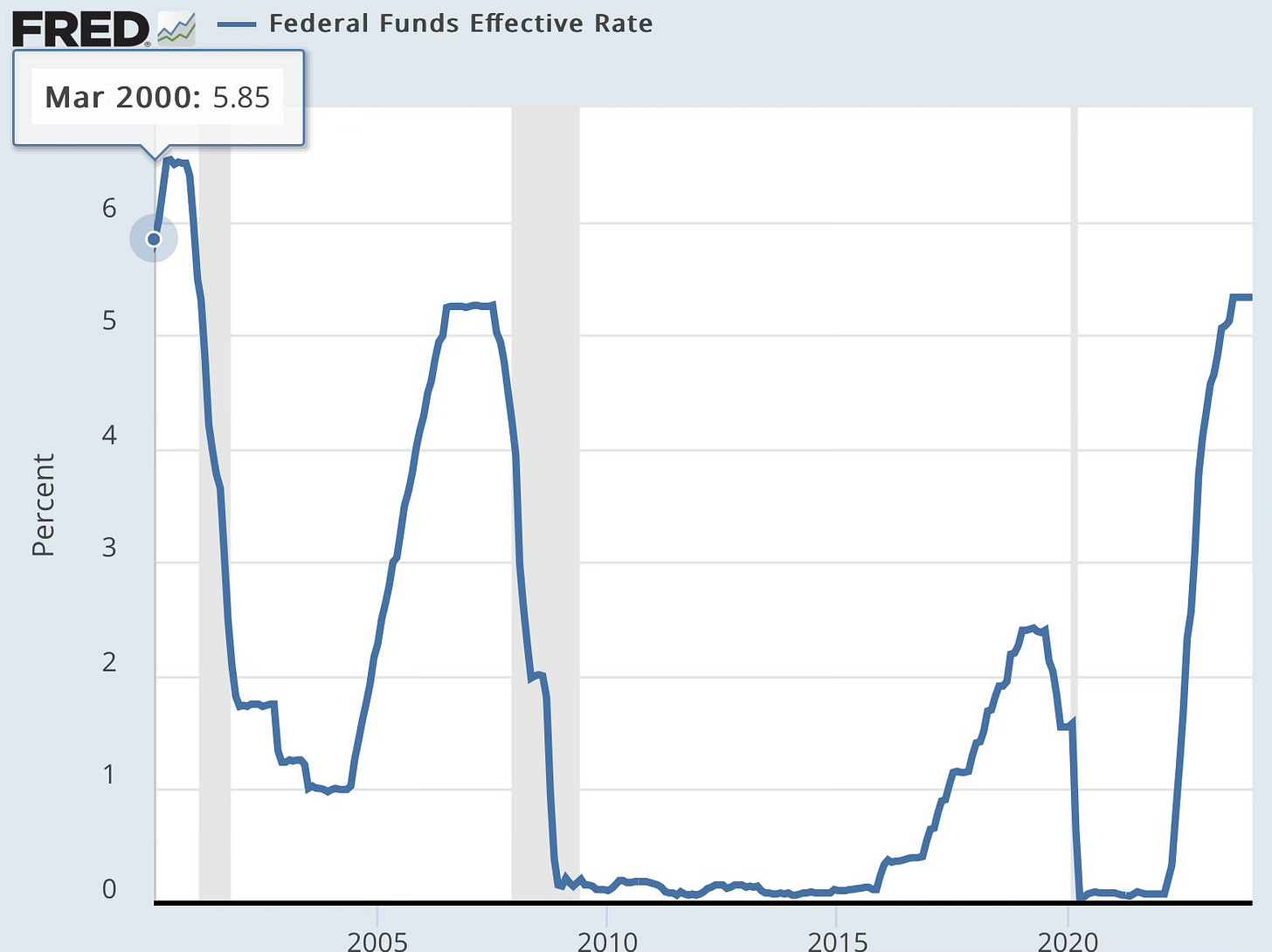

Insights from the FOMC notes indicate the Federal Reserve's cautious stance on early rate cuts. This bodes well for assets associated with higher risk, such as stocks and cryptocurrencies. Historical trends suggest that when the Fed initiates agressive rate reductions, risk-on assets tend to decline, often leading in to a recession → compare grey recessionary areas in the rate chart below.

Tweet of this week —> “Monster $1.3BN Bitcoin buy - 26,200 BTC at $51K”

Current status 100% Winning strategy: 🔵—> ALL-IN

Bitcoin (BTC)

The Long-Term Holder Net Unrealized Profit/Loss (NUPL) assesses market sentiment, ranging from Capitulation (red) to Euphoria (blue). Bitcoin's recent price movements have pushed this indicator deep into the green zone, specifically into the Belief - Denial range. This shift in sentiment can be witnessed directly through platforms like X. Historically, when transitioning from the capitulation zone to the green zone, Bitcoin's price has rallied directly to a state of Euphoria sentiment two out of three times. The only exception to this trend was during the COVID dip. However, considering the current macroeconomic conditions, a repetition of this scenario seems unlikely. Stocks are surging, and the Federal Reserve is expected to maintain interest rates in the coming months. This suggests there is significant momentum for Bitcoin to surge to $200k and for long-term hodlers to once again experience Euphoria.

Bitcoin's holds strong above the 78.6% Fibonacci level on the monthly chart.