The information and insights are based on my knowledge; don’t take it as financial advice.

News

Global markets crashed on "Japan Monday" due to multiple factors:

The Nikkei plunged 12%, its steepest decline since 1987, following last week's rate hike by the Bank of Japan, which forced traders to unwind carry trades.

Concerns about a potential U.S. recession have intensified, with fears that the Federal Reserve is too slow in cutting rates.

Rising tensions in the Middle East further fueled market panic.

Major institutions like BlackRock, Fidelity, Grayscale, and MicroStrategy have held onto their Bitcoin despite the market turmoil.

The U.S. stock market lost over $1.41 trillion today.

The Russian parliament has passed a bill allowing cross-border payments with cryptocurrency. El Salvador has proposed using Bitcoin and other cryptocurrencies for trade with Russia.

The Federal Reserve has left interest rates unchanged, maintaining the range of 5.25% - 5.50%.

Michael Saylor's MicroStrategy plans to raise $2 billion to purchase more Bitcoin.

Morgan Stanley, managing $1.3 trillion in assets, will enable advisors to offer clients spot Bitcoin ETFs.

Capula Management, Europe's fourth largest hedge fund, has disclosed $500 million in spot Bitcoin ETF holdings.

Tweet of the week —> “I keep hearing about 200k BTC owned by the US Government. 96k BTC is from the Bitfinex hack, after due process I would expect those stolen funds to be returned to Bitfinex.”

Current status 100% Winning strategy: 🔵—> ALL-IN

a weekly candle close below $52.3k would flash the black signal.

Bitcoin

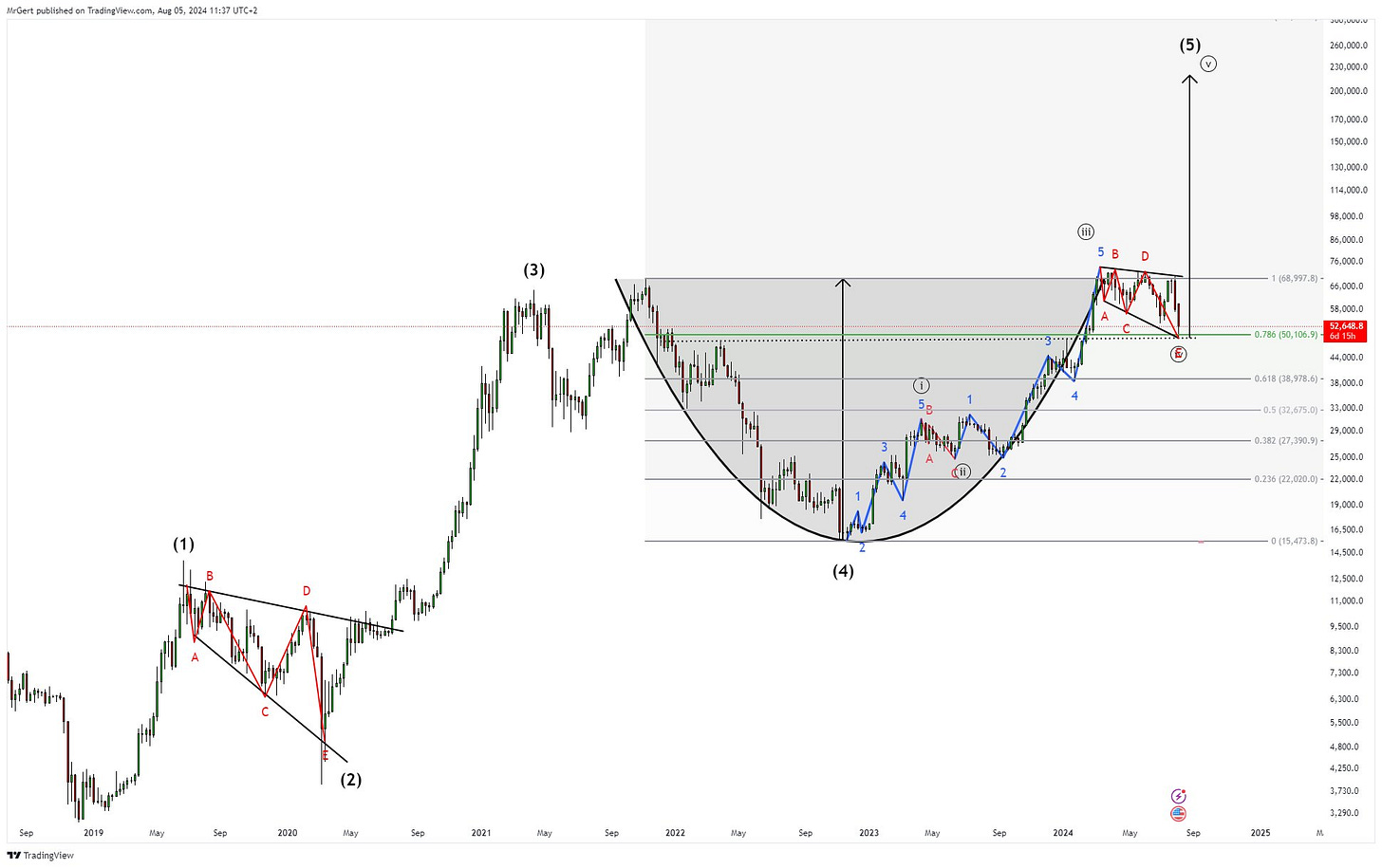

The volatility index is at levels that increase the probability of Bitcoin reaching $200,000 in August or September this year. Due to the high volatility, the potential monthly spread has expanded significantly. With a recession looming, there is limited time for the crypto market to experience a blow-off top. The chart below summarizes the probability of wave 5 to play out within each month. Important lines above which BTC needs to close: $52.3k and ultimately $31.8k.

Some signals hinting at a recession within a few months from now:

Sahm’s rule has triggered;

10-2Y yield shortly reversed back above zero today after being inverted since Jul-22; once it leaves the zero line with strength historically a recession was at hand;

Fed’s about to cut rates in September or maybe earlier depending on market conditions;

During today’s global market crashes, Bitcoin has tested it’s bull market support at $50k (0.786 Fib. level). Given the fact price has printed a local lower low, it’s clear price is still within the iii-iv correction and the anticipated final blow-off wave iv-v hasn’t started yet. Invalidation for wave iv-v to play out lies at $31.8k. Based on historical data a fifth wave seems unlikely whenever price closes two Fibonacci levels lower, in this case a close below $40k. Also a weekly close below the $52.3k price level would complicate things for a swift recovery and expansion to $200k.

Notice how wave iii-iv now qualifies as a descending broadening wedge, comparable to the correction containing the COVID-dip [(1)-(2)].